Idaho Dmv Sales Tax Exemption Form – In order to be exempt from sales tax, an employee must be able to make sales. This can be often achieved simply by making marketing acquisitions or helping another employee shut offers. The staff member need to, even so, participate in impartial product sales attempts. Additionally, the surface income exemption only pertains to workers who execute business away from the company’s amenities, for example at trade displays. Normally, an outside income exemption document needs to be presented through the worker. Whenever a staff member engages in outside the house sales activity, this type is essential. Idaho Dmv Sales Tax Exemption Form.

Income income tax is not applicable to low-income agencies.

A 501(c)(3) charitable business is typically exempt from having to pay sales tax, yet it is not exempt from getting or remitting it. However, the nonprofit organization is permitted to sell taxable goods without collecting sales tax as long as it complies with specific standards. Concrete personalized home is the thing that charity agencies can sell that may be taxable. Charity businesses should match the condition-certain requirements for exemption.

In order to qualify as a nonprofit, the organization needs to fulfill a number of criteria, such as purpose, payment, and purchase quantity. Sales taxes exemptions for nonprofits should be required in their property express and any neighboring says. Attaining income-taxes exemptions in lots of suggests, including with all the Efficient Product sales and employ Tax Arrangement Certificate of Exemption, will also be beneficial for not for profit companies. Nonprofits need to, nevertheless, generally keep in mind the constraints put on income-tax exemptions.

Income taxation is not used on on the internet vendors.

According to a recent survey, the majority of internet sellers are free from collecting sales tax, but the number of exemptions is rapidly rising. These exclusions give modest, in your area owned and operated organizations an important advantage for them to contend with large federal shops. If these exclusions are eliminated, the competitiveness and profitability of small enterprises will suffer. Compared to large businesses, small enterprises are frequently much more entrepreneurial and flexible in terms of new technological innovation.

In fact, the Wayfair ruling positions a special focus on on the web marketplaces and mandates they accumulate sales tax using their thirdly-get together sellers. Many on-line sellers, including Amazon online, eliminated this need for a long time before you start to cost sales tax to the goods and services they provide. Even with getting actual physical locations in a few claims, Amazon online only gathers income taxes in the products they offer instantly to buyers. These vendors should to cautiously take a look at their business online approach and confirm that the correct sales income tax is being compensated.

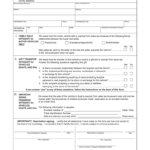

You should send Develop ST-12.

When asking for a sales taxation exemption, a valid qualification of exemption is essential. If a purchase is made with the principal use in mind, a sales tax exemption may be requested. A tangible private item or service is reported to be in its main use when it is utilized for a minimum of 50Percent of times. A income income tax exemption certification has to be presented to the owner through the shopper of the exempt very good or support. The seller is mainly responsible for delivering facts.

By submitting Form ST-12, a firm can request a tax exemption certificate. In order to withdraw it if the company is no longer eligible for the sales tax exemption, the seller is required to give the vendors the form. The utilization of exemption use certificates is governed by Massachusetts Regulation (830 CMR 64H.8.1). Criminal consequences may apply if an exemption certificate is knowingly misused. A business could deal with the two criminal and civil charges for intentionally splitting this tip.

The certificate’s several-season expiry particular date

Nearly all folks are unaware that certification end after 5 years. Because they haven’t been employed in this time, they can be will no longer probably going to be genuine. In truth, it’s typical for a card or certificate to expire for more than ten years; therefore, if you want to continue using it, you must obtain a new one. You are protected from this circumstance by the law. That’s the good news.

Once your official document is because of end, SSL official document companies send out notices on their submission lists. When your certificate comes up for renewal, your Point-of-Contact might not be available,. That is the issue. In fact, as soon as the certification expires, you may obtain a advertising or get fired. Thankfully, by making use of these methods, you might stay out of this problem. You could expand the lifespan of your SSL official document using these easy tips.