Agricultural Tax Exempt Form Nys – Tax Exemption Types appear in a variety of varieties. Such as the Contractor’s Exemption Certificate, Assistance in Overcome, MIT, and Quasi-Govt. If you are unclear of your particular circumstance, you can check the details on each form type below to decide which one is best for you. You can get a copy of this form from your county assessor if you don’t already have one. You are able to mail or digitally publish the shape towards the Division when you’ve completed it. Agricultural Tax Exempt Form Nys.

Official document of Contractor’s Exemption

To acquire building items that are exempt from income income tax, building contractors in the condition of Illinois need to have a Contractor’s Exemption Qualification taxes exemption form. A qualification applies to the undertaking it brands and also the contract’s explained value. A new exemption certificate would be necessary if you got a new contract. You must give your subcontractor a copy of your exemption certificate if you’re working with one in the state of Wisconsin.

Quasi-govt

One type of quasi-government establishment can be a development and research service backed up by the government. To satisfy a national require, these companies blend components of people and personal market sectors. Federal labs were produced in the course of The Second World War as crossbreed establishments that gotten government loans but have been privately operate by low-federal government organizations. Because of the fact these businesses have been exempt from basic administration and civil service norms, these people were extremely effective through the conflict.

Armed service member

If you are a member of the military and have served in a combat area, you can be eligible for a federal tax exemption. The exception to this rule can mean a good deal. You may save approximately $2,000 annually in national taxes thanks to the tax exemption. But understand that since Sociable Security and Medicare taxes are not exempt, military salary is not taxation-free of charge. So, it’s crucial to fill out a tax exemption form.

MIT

If you have the status of a foreign national, you might have to submit a tax exemption form. With the Sprintax Income tax Willpower Program, you can accomplish this. You may opt to have your government and condition income taxes withheld by accomplishing the Atlas kind. At the start of your scheduled appointment, you need to then give you the develop to MIT. Staff members at MIT should also send their earnings towards the Internal revenue service. Contact MIT’s payroll office if you’re unsure if tax withholding applies to you.

Internal revenue service perseverance message from MIT

According to the IRS determination letter an organization is granted federal tax exemption. Without this, the office of profits can only unconditionally acknowledge Form G-6. A conditional authorization, nevertheless, could be modified right into a long lasting exemption. The organization’s taxation-exemption program must as a result consist of MIT’s Internal revenue service perseverance letter for taxes exemption type. If MIT is granted tax-exemption in the IRS determination letter, it is obvious that the organization’s tax-exempt status is secure.

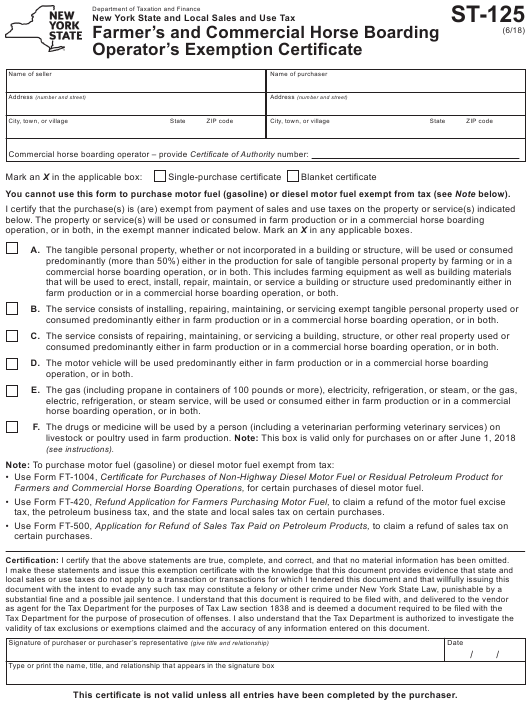

Farm machines that may be not exempt

You might not be aware of the tax exemption on farm equipment if you are leasing or buying agricultural machinery. Agriculture is the raising and harvesting of any commodity, according to the IRS. It involves developing poultry, dairy cows, and even molluscan shellfish. People who are involved in the purchase and selling of agricultural products are not regarded as those who produce agriculture, however. You can still buy farm machinery that is eligible for a tax exemption permit, though.

Agriculture-associated products

Several gardening products fit into the taxation-exempt group. Such as gardeninglivestock and equipment, and crops. It is possible to request income tax exemptions on this stuff using the FS-1053 develop. You must submit a tax exemption form if you sell or lease agricultural equipment. Moreover, there is absolutely no income income tax on these materials. For a number of stuff that aren’t considered to be gardening goods, a taxation exemption develop is available.

building materials

Comprehending the conditions for the construction materials tax exemption develop is essential when constructing a residence. Building materials are tangible pieces of individual property that are utilized in creating constructions or generating terrain enhancements. When they are combined to the genuine genuine home, these components are will no longer recognizable as individual house. These supplies and materials consist of all those found in construction and landscaping. Devices employed for warehousing, such as personal computer solutions, racking techniques, and conveying products, is likewise clear of development substance income tax.

warehousing resources

A warehousing equipment tax exemption form is a necessary tool if you work in the industry of keeping products. Racking methods, promoting systems, and computers systems are a few of these bits of machinery. However, did you realize that warehouse equipment is exempt from taxes? Having warehousing devices are beneficial for a lot of reasons. Below are a few illustrations: