Florida Sales Tax Exemption Application Form – In order to be exempt from sales tax, an employee must be able to make sales. This is certainly commonly attained simply by making marketing buys or aiding another worker close deals. The employee must, however, take part in impartial sales endeavours. Furthermore, the exterior income exemption only applies to personnel who conduct business out of the company’s facilities, such as at industry displays. Usually, an outside sales exemption file needs to be offered by the staff. Each time a worker engages in outside the house revenue process, this type is needed. Florida Sales Tax Exemption Application Form.

Revenue income tax is not really relevant to no-earnings companies.

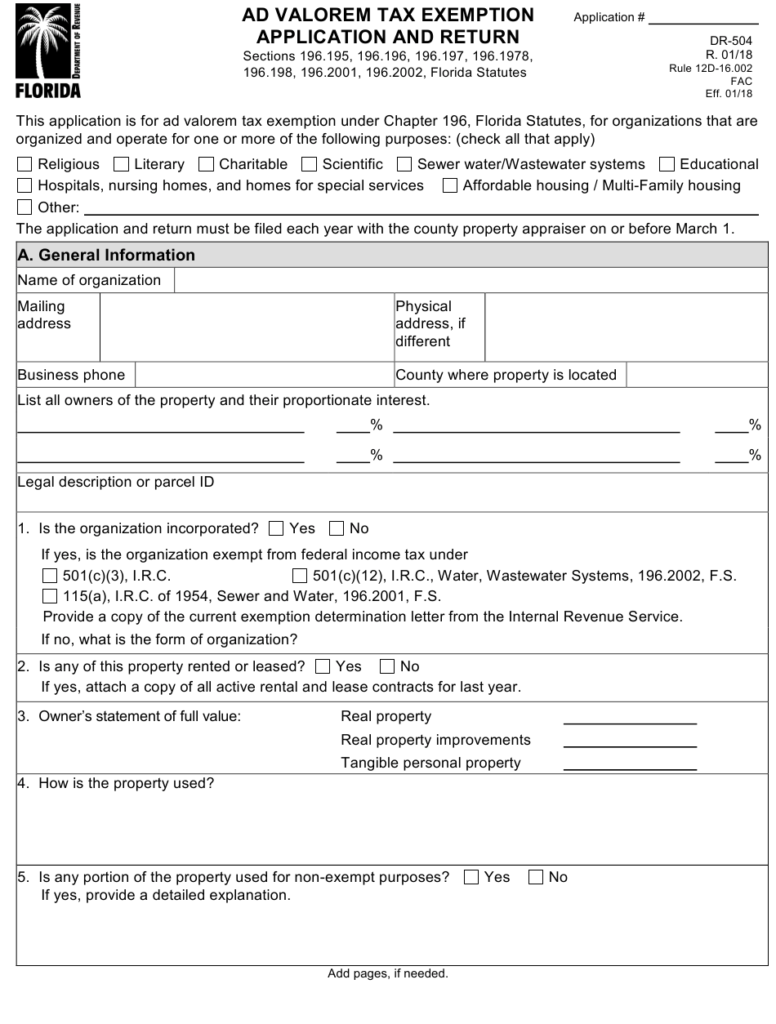

A 501(c)(3) charitable firm is usually exempt from having to pay product sales tax, however it is not exempt from collecting or remitting it. The nonprofit organization is permitted to sell taxable goods without collecting sales tax as long as it complies with specific standards, however. Tangible individual house is exactly what not-for-profit organizations can sell that is certainly taxable. Not for profit businesses need to match the status-particular specifications for exemption.

In order to qualify as a nonprofit, the organization needs to fulfill a number of criteria, such as purpose, payment, and purchase quantity. Revenue income tax exemptions for nonprofits needs to be required inside their house status and any nearby claims. Achieving revenue-tax exemptions in many says, like together with the Streamlined Product sales and Use Taxation Contract Official document of Exemption, will also be helpful for nonprofit companies. Nonprofits must, nonetheless, generally keep in mind the restrictions added to sales-taxes exemptions.

Revenue tax will not be put on on the internet sellers.

The majority of internet sellers are free from collecting sales tax, but the number of exemptions is rapidly rising, according to a recent survey. These exclusions offer tiny, nearby possessed enterprises a significant advantage to allow them to contend with big countrywide stores. The competitiveness and profitability of small enterprises will suffer if these exclusions are eliminated. Compared to huge companies, modest enterprises are often more entrepreneurial and versatile with regards to new technology.

In fact, the Wayfair judgment puts a particular focus on on the internet marketplaces and mandates they accumulate income tax from their 3rd-party retailers. Several on the internet retailers, which includes Amazon online marketplace, averted this need to have for many years before starting to cost product sales taxes for that goods and services they feature. Regardless of getting physical places in some states, Amazon . com only collects income tax in the items they offer directly to customers. These sellers should to carefully analyze their web business method and make sure that the correct product sales taxes has been paid out.

You have to submit Form ST-12.

When requesting a product sales taxation exemption, a legitimate certificate of exemption is needed. A sales tax exemption may be requested if a purchase is made with the principal use in mind. A concrete personalized object or service is said to be in their primary use when it is applied for a minimum of 50Per cent of the time. A income income tax exemption official document must be offered to the owner by the buyer of an exempt excellent or support. The seller is mainly responsible for delivering evidence.

A firm can request a tax exemption certificate, by submitting Form ST-12. In order to withdraw it if the company is no longer eligible for the sales tax exemption, the seller is required to give the vendors the form. The utilization of exemption use certifications is governed by Massachusetts Legislation (830 CMR 64H.8.1). If an exemption certificate is knowingly misused, criminal consequences may apply. A firm could deal with equally civil and criminal penalties for deliberately breaking up this principle.

The certificate’s five-season expiration date

The vast majority of individuals are ignorant that accreditations expire soon after five years. Simply because they haven’t been utilized inside that point, they can be will no longer apt to be legit. In truth, it’s typical for a card or certificate to expire for more than ten years; therefore, if you want to continue using it, you must obtain a new one. You are protected from this circumstance by the law. That’s the good news.

Once your certificate is caused by expire, SSL certificate companies send notifications on their syndication listings. When your certificate comes up for renewal, your Point-of-Contact might not be available,. That is the issue. Actually, as soon as the qualification finishes, you could get yourself a campaign or get fired. Luckily, by using these strategies, you may avoid this predicament. You could lengthen the life of the SSL qualification using these effortless tips.