Form Homestead Exemption Wa State – To get tax-exempt whilst marketing goods or services, you should send a Condition Exemption Type. There are other ways to get this form, but applying online is the most popular one. If you accomplish’t know what to glimpse for, the procedure can be confusing. Under are the specifications for a certification, in addition to a number of illustrations. To begin with correctly filling in the form, ensure you are mindful of what it really demands. Form Homestead Exemption Wa State.

reductions in product sales fees

A official document exempting a business from remitting and collecting revenue fees is actually a product sales taxes exemption certificate. For several types of transactions, such as all those made by the us government or not-for-profit companies, exemption accreditations are essential. Vendors are still required to maintain their exemption documents, though sales tax is not applied to nontaxable items. Some merchandise are excluded from income income tax, thus before sending a revenue taxes, you need to affirm that your purchase is exempt.

In accordance with the type of residence sold, some says have really various sales income tax exemptions. The vast majority of claims regard some goods as demands and grant exemptions in line with the product. This stuff incorporate things such asfood and clothes, and prescribed drugs. Suggests that do not entirely exempt certain goods normally have lower income tax rates. Continue studying to learn far better concerning your state’s revenue tax exemptions. Here are a few valuable information to help you be sure you don’t miss out on useful taxes advantages.

Specifications

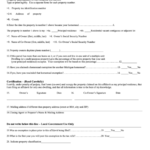

You will find distinct must complete your status exemption develop, regardless of whether you’re marketing an item on the web or even in your actual retail store. The exemption kind is provided through the Vermont Section of Taxes. This kind must becompleted and signed, and utilized exclusively for the given explanation. Additional assisting details may be needed in the develop to indicate the property’s exemption. This form could be acceptable in a couple of legal system depending on the status.

You must send particular documents when asking for an exemption, such as an invoice as well as a revenue slide. For instance, you must file a “Multiple Purchase” certificate if you are selling tangible personal property. Moreover, you’ll want a current Qualification of Influence. These documents may be able to save you from having to pay sales tax if you sell to numerous states. As soon as the documents continues to be presented, you will end up eligible to avoid having to pay income tax.

Examples

Samples of state exemption forms are necessary for smaller businesses who aim to avoid paying out revenue tax. Several buys can be produced using this type of pieces of paper. There are several exemption certificates, but they all call for the same fundamental data. No in the exemption, the organization operator need to sustain an up-to-date official document. Samples of express exemption forms are demonstrated listed below. Read on for more information on them. You power be surprised at how effortless it is to try using them to economize!

The transaction of products to the public for non-business motives is a kind of condition tax exemption. This tax crack is designed to advertise both the common welfare as well as a specific business. A production line, for example, could be excluded from paying out sales taxation on supplies employed to make the finished product or service. This could pertain to the machines and tools the company uses to create the great. These transactions will let the organization in order to avoid spending product sales taxation.

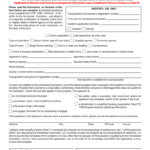

Circumstances to obtain a official document

An organization must complete a tax exemption form in order to get a certificate of state tax exemption. An institution or governmental system that may be exempt from sales taxes need to provide the data in the form. Component 2 of your form has to be filled out by a 501(c)(3) organization or from the authorities. Additionally, it must use the goods or services it has purchased in order to conduct business. This certification is at the mercy of small constraints, and using it improperly can lead to its cancellation.

There are various kinds of certifications which can be used to have a product sales taxation exemption. Some are recognized at an on-line merchant and given digitally. Each state features its own set of policies for getting these files. If you are selling taxable property in New York, in general, a valid Certificate of Authority is required. However, a certificate of exemption issued by another state or another nation cannot be applied to the New York State sales tax.

In order to acquire an exemption certificat, criteria to meete

You ought to also take into account the distinct needs for the enterprise when deciding on the suitable express income tax level. They must in order to avoid having to do so, although for instance, a company selling widgets may not be required to collect sales tax in Florida. Several states do not compel them to pay sales tax if a company does not have a nexus with a state. In this situation, the business is needed to obtain an exemption official document through the condition where they perform organization.

A developing professional can also buy constructing materials for the undertaking for any taxes-exempt company having an exemption official document. The General Contractor must submit an application for a trade name and license in order to obtain a copy of an exemption certificate. Before hiring subcontractors, a building contractor must have the certificate. The state’s Assistant of State’s Company Center is where the service provider also must distribute an application to get a buy and sell label certificate. Development agreements with taxes-exempt organizations’ exemption certifications, plus the revival and sign up of buy and sell names, are taken care of with the Assistant of State Organization Heart.