Homestead Exemption Form Nueces County Texas – How ought to a area exemption form be filled out? You will find a the occasional issues you have to know prior to starting. The prerequisites for making use of and the output deadlines are detailed in this article. To ensure the process goes as smoothly as possible, keep these suggestions in mind if you’re thinking about submitting an exemption application. The savings you’ll know when you do will astound you. When guaranteeing that your region receives a lot more government backing, you’ll be capable of retain more cash in your pocket. Homestead Exemption Form Nueces County Texas.

Obtaining Area Exemptions

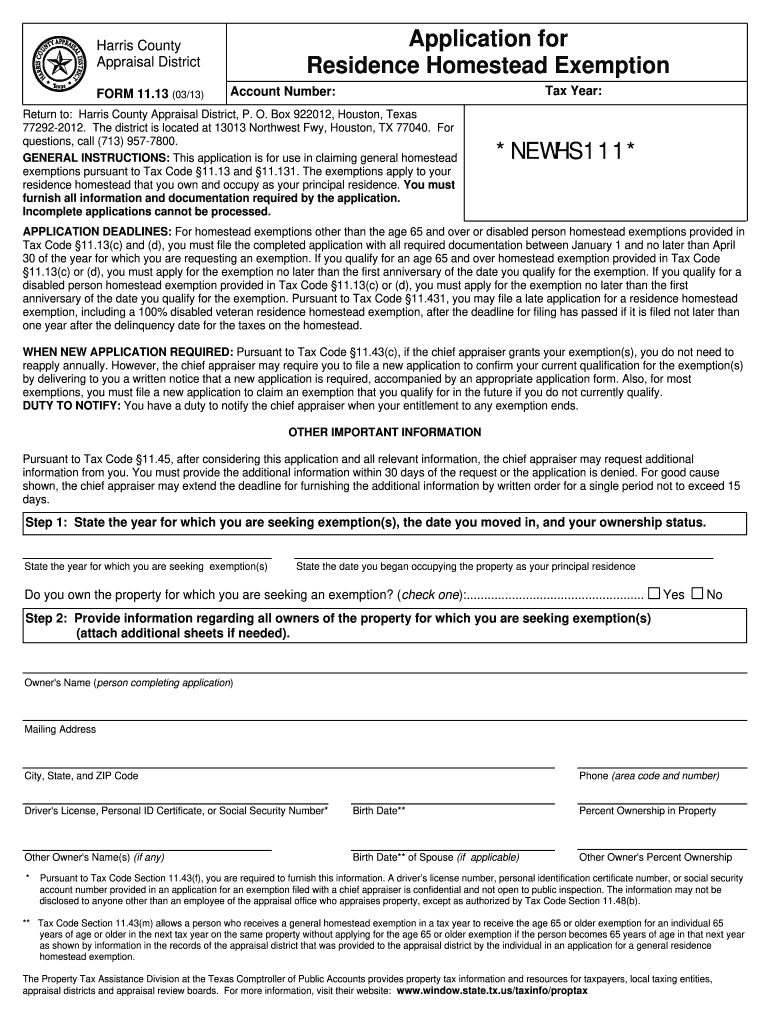

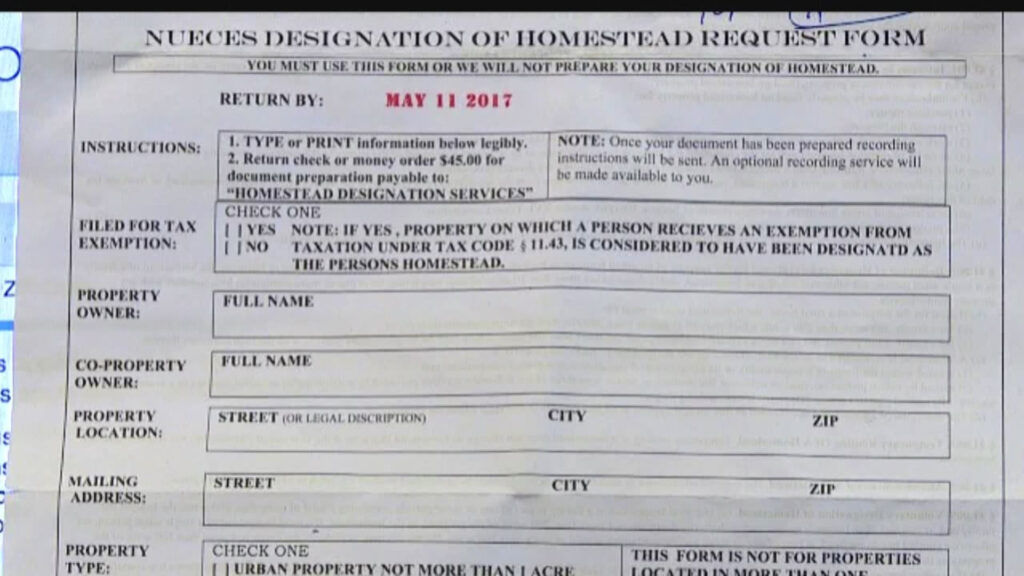

You must first submit an Application for County Exemptions in order to be granted an exemption for your property. 6 duplicates with this type needs to be carried out in its entirety. Your application can be submitted at any time of the year, although it is advised that you do so as soon as feasible. This will likely guarantee available the essential exemption. You ought to know that any taxing expert could contest your exemption. As a result, it’s crucial to adhere to all filing dates.

You must attractiveness the denial of your exemption. This attraction has a 30-day declaring timeline. You need to send an appeal to the worth Change Table soon after being declined. You should also include any supporting records for the claim. Throughout the seeing and hearing, the Property Appraiser can also be current. You must data file a lawsuit in circuit judge when the VAB policies on your appeal. There is a $15 processing charge.

Conditions for using

Review the eligibility conditions first before submitting the application. All candidates are required to submit their Social Security Numbers as well as, if relevant, the numbers of any spouses. All people should also display management documents, such as a reported deed or perhaps a taxes bill from Lee Region. A copy of the trust document and documentation proving your authority to make decisions for the trust are required if you own the property through a trust. Any trustees you might have about the home also needs to indication the application in their potential as trustee.

You need to make a certain amount of funds to be eligible for an exemption. If your household has a high income, you can qualify for a homestead exemption. You must be 62 years old or older to be eligible, although homeowners who meet the requirements can receive homestead exemptions. Home owners 62 numerous years of yrs and more mature may also be exempt from some extra fees. You might not be required to pay any property taxes if you are eligible for one of these programs.

Situations for processing

Knowing the submitting criteria is essential when requesting a homestead exemption. Homeowners who meet the qualifications might earn a $7,000 reduction in their assessed worth, according to California law. The house must have been the owner’s primary residence as of the lien date in order to qualify. In order to file, homeowners need complete the BOE-266 form, which can be obtained from the county assessor’s office. First, no later than February 15; the form must only be submitted once, although time candidates can submit the form whenever they become eligible.

You must individual your property and stay 65 years of age or more aged to be eligible for the More than 65 exemption. The only real manager or tenant of the residence should be you. The house have to work as your primary residence. You could possibly distribute a software whenever you want as soon as you change 65. You must also existing documentation of your respective residency and age. To indicate your qualifications, you need to have a state-granted ID. The application is only accepted if you have all the necessary paperwork on hand.

Document-by schedules

Your property must fulfill certain requirements in order to be qualified for a tax relief. Most areas use a time frame through which programs for taxes exemptions needs to be presented. Before submitting if you are filing on someone else’s behalf because you will need to provide evidence that they will not be using the property, make sure you are aware of the deadline. Such as owning a home for a disabled person, many counties can grant you an additional tax relief, if you fulfill specific requirements. Typically, requesting a tax exemption involves filling out documentation and paying a charge. You can submit an exemption form on your own to request a tax reduction if you’re working with a tax expert.

Before submitting an application, candidates should confirm that they possess a valid Texas driver’s license and a DPS identification card. Furthermore, they should validate the street address on his or her Identification and also the 1 on their program are the same. You can contact the Fort Bend Central Appraisal District to learn more about filing requirements if you’re unsure whether your home qualifies for an exemption. You need to keep in mind the May 15th time frame has gone by for submitting an organization individual residence develop.

accomplishing the shape

Filling out the state exemption type might be difficult, regardless of whether you’re searching for a home exemption or even a commercial exemption. In order to begin, you must first choose the appropriate exemption type for you. Following, establish the taxes many years for which you are skilled to the exemption. If you don’t fulfill all of these standards, your application will probably be denied or not taken into consideration.

Even if they don’t live in the property, the majority of taxpayers are required to submit an application to their assessor in order to claim an exemption. Property owned by the state of Minnesota doesn’t need to, though others are required to file every three years. You could possibly sometimes be asked to finish a different application. It is recommended to get guidance out of your region auditor’s workplace such scenarios.