How To Fill Out A Michigan Sales Tax Exemption Form – In order to be exempt from sales tax, an employee must be able to make sales. This is often achieved through making promo acquisitions or supporting another worker shut deals. The worker have to, nonetheless, take part in self-sufficient sales endeavours. Furthermore, the surface sales exemption only is applicable to staff members who execute organization from the company’s facilities, like at trade exhibits. Normally, some other sales exemption record should be presented from the personnel. Every time a member of staff engages in exterior revenue activity, this kind is necessary. How To Fill Out A Michigan Sales Tax Exemption Form.

Product sales income tax is not relevant to no-revenue companies.

A 501(c)(3) non-profit organization is generally exempt from spending income income tax, but it is not exempt from accumulating or remitting it. However, the nonprofit organization is permitted to sell taxable goods without collecting sales tax as long as it complies with specific standards. Real individual property is really what nonprofit companies can promote that is taxable. Not for profit businesses must fulfill the condition-certain specifications for exemption.

The organization needs to fulfill a number of criteria, such as purpose, payment, and purchase quantity, in order to qualify as a nonprofit. Product sales taxation exemptions for nonprofits should be requested with their property state as well as neighboring says. Achieving revenue-income tax exemptions in numerous states, including using the Streamlined Income and make use of Taxes Arrangement Certification of Exemption, can be beneficial for charity organizations. Nonprofits must, nevertheless, constantly be aware of the constraints placed on sales-taxes exemptions.

Revenue tax is not really placed on on the internet sellers.

According to a recent survey, the majority of internet sellers are free from collecting sales tax, but the number of exemptions is rapidly rising. These exclusions provide tiny, nearby owned or operated enterprises a significant advantages so they can contest with large countrywide merchants. The competitiveness and profitability of small enterprises will suffer if these exclusions are eliminated. In comparison with huge organizations, modest enterprises are usually much more entrepreneurial and flexible in relation to new technology.

In fact, the Wayfair judgment places a special emphasis on on the internet marketplaces and mandates which they accumulate revenue tax using their 3rd-get together vendors. A lot of on the web merchants, such as Amazon online, avoided this need to have for quite some time before you start to charge sales taxes for that goods and services they provide. In spite of getting bodily places in many says, Amazon . com only gathers product sales taxation around the merchandise they sell instantly to customers. These merchants must to meticulously analyze their web business approach and confirm that the appropriate product sales taxation is now being paid for.

You should distribute Form ST-12.

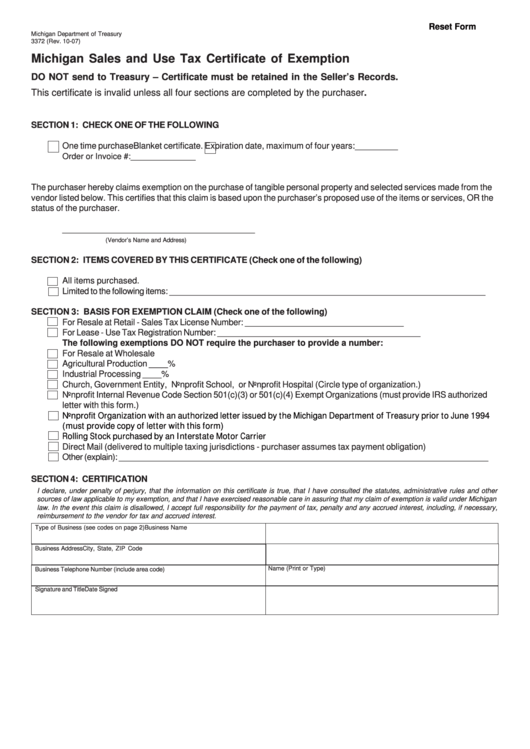

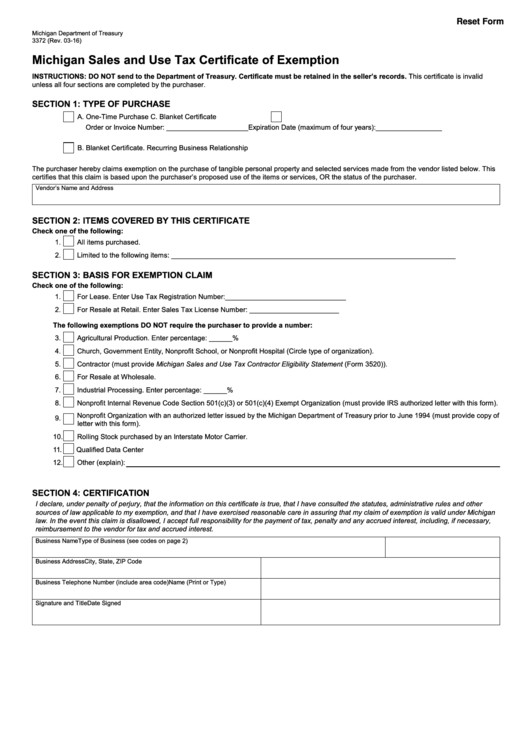

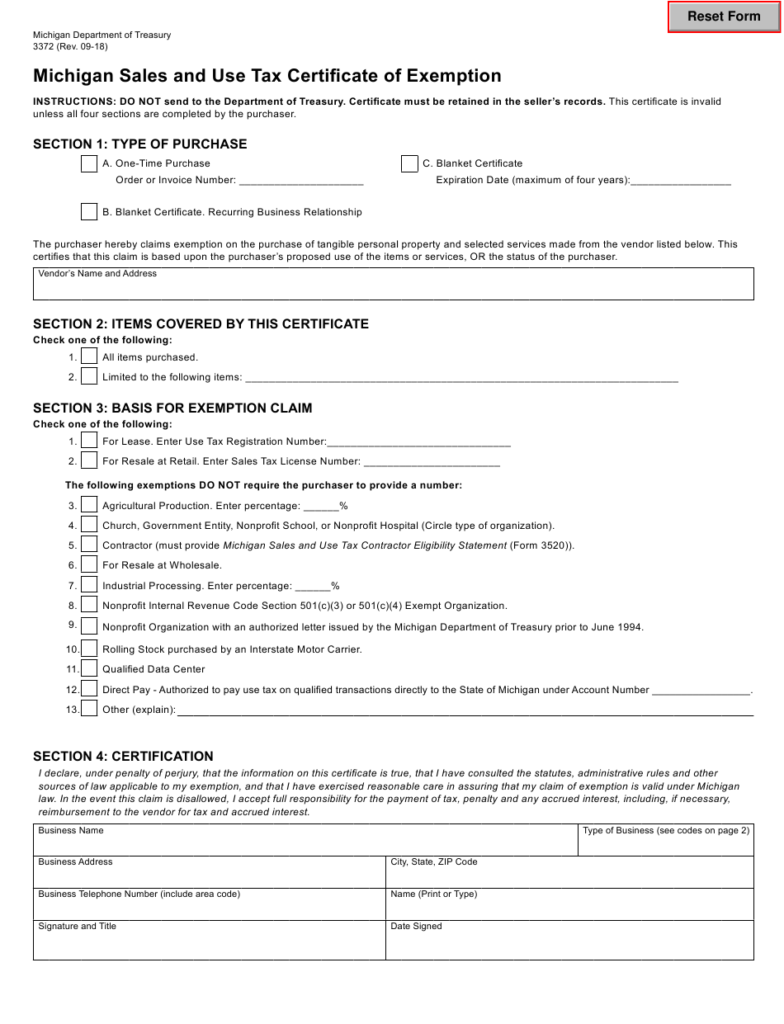

When requesting a product sales tax exemption, a legitimate qualification of exemption is necessary. If a purchase is made with the principal use in mind, a sales tax exemption may be requested. A real personal item or service is reported to be within its principal use when it is utilized for at least 50Per cent of times. A income tax exemption certification must be given to the owner by the buyer of your exempt great or assistance. The owner is responsible for offering proof.

A firm can request a tax exemption certificate, by submitting Form ST-12. The seller is required to give the vendors the form in order to withdraw it if the company is no longer eligible for the sales tax exemption. The usage of exemption use accreditation is governed by Massachusetts Legislation (830 CMR 64H.8.1). Criminal consequences may apply if an exemption certificate is knowingly misused. A firm could deal with the two civil and criminal fees and penalties for deliberately breaking this principle.

The certificate’s 5 various-year expiry particular date

The majority of folks are oblivious that qualifications expire soon after 5 years. Given that they haven’t been utilized in this time, these are no longer apt to be legit. In truth, it’s typical for a card or certificate to expire for more than ten years; therefore, if you want to continue using it, you must obtain a new one. The good news is that you are protected from this circumstance by the law.

As soon as your certificate is caused by end, SSL certificate service providers send notifications on their submission databases. When your certificate comes up for renewal, your Point-of-Contact might not be available,. That is the issue. The truth is, as soon as the official document finishes, you might get yourself a campaign or get fired. The good news is, by making use of these tactics, you could possibly stay out of this problem. You may lengthen the life span of your own SSL qualification using these straightforward recommendations.