Il Sales Tax Exemption Form For Church – In order to be exempt from sales tax, an employee must be able to make sales. This is commonly accomplished by making promo buys or helping one more staff close up deals. The employee must, nevertheless, engage in impartial sales endeavours. In addition, the outer sales exemption only applies to personnel who execute organization from the company’s facilities, including at industry shows. Normally, a third party sales exemption record has to be provided from the employee. Whenever a staff member engages in outside revenue action, this form is necessary. Il Sales Tax Exemption Form For Church.

Product sales tax is just not appropriate to no-revenue agencies.

A 501(c)(3) non-profit business is normally exempt from paying product sales income tax, but it is not exempt from gathering or remitting it. However, the nonprofit organization is permitted to sell taxable goods without collecting sales tax as long as it complies with specific standards. Perceptible personal home is the thing that not-for-profit organizations can offer which is taxable. Charity agencies should match the status-certain requirements for exemption.

In order to qualify as a nonprofit, the organization needs to fulfill a number of criteria, such as purpose, payment, and purchase quantity. Product sales taxation exemptions for nonprofits should be required inside their house status and any nearby says. Gaining product sales-income tax exemptions in many claims, like together with the Streamlined Sales and employ Tax Agreement Certificate of Exemption, will also be advantageous for not for profit businesses. Nonprofits ought to, however, usually be aware of the limitations put on income-taxes exemptions.

Income tax is not really used on on the web vendors.

The majority of internet sellers are free from collecting sales tax, but the number of exemptions is rapidly rising, according to a recent survey. These exclusions supply tiny, regionally owned enterprises a tremendous edge to allow them to contest with major federal stores. If these exclusions are eliminated, the profitability and competitiveness of small enterprises will suffer. In comparison to large companies, tiny enterprises are often much more entrepreneurial and flexible in terms of new technologies.

In fact, the Wayfair judgment puts an exclusive emphasis on on the internet marketplaces and mandates which they acquire income taxation from their next-party retailers. Several on-line merchants, including Amazon online, eliminated this need for a long time prior to starting to demand income income tax for that goods and services they provide. Even with having actual physical locations in a few claims, Amazon online only collects product sales taxation on the items they sell instantly to customers. These sellers have to to carefully analyze their online business approach and make sure how the proper product sales taxes has been paid for.

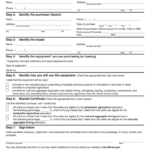

You need to submit Kind Saint-12.

When asking for a income tax exemption, a valid official document of exemption is necessary. A sales tax exemption may be requested if a purchase is made with the principal use in mind. A tangible personalized item or services are reported to be in their primary use when it is employed for about 50Percent of the time. A income income tax exemption qualification needs to be provided to the vendor by the customer of your exempt great or service. The owner is mainly responsible for providing proof.

A firm can request a tax exemption certificate, by submitting Form ST-12. In order to withdraw it if the company is no longer eligible for the sales tax exemption, the seller is required to give the vendors the form. The usage of exemption use accreditation is controlled by Massachusetts Regulation (830 CMR 64H.8.1). Criminal consequences may apply if an exemption certificate is knowingly misused. An organization could deal with each civil and criminal charges for intentionally busting this principle.

The certificate’s 5 various-calendar year expiration date

Virtually all people are oblivious that qualifications end soon after five-years. Since they haven’t been utilized in that time, they are will no longer likely to be genuine. In truth, it’s typical for a card or certificate to expire for more than ten years; therefore, if you want to continue using it, you must obtain a new one. The good news is that you are protected from this circumstance by the law.

When your certificate is due to expire, SSL qualification providers deliver notices for their distribution listings. When your certificate comes up for renewal, your Point-of-Contact might not be available,. That is the issue. Actually, if the certificate finishes, you might get yourself a campaign or get fired. Luckily, by using these techniques, you could avoid this predicament. You could expand the life of your own SSL qualification utilizing these effortless tips.