Illinois Resale Tax Exempt Form – Income tax Exemption Kinds appear in many different forms. Some examples are the Contractor’s Exemption Certificate, Support in Fight, MIT, and Quasi-Authorities. If you are unclear of your particular circumstance, you can check the details on each form type below to decide which one is best for you. If you don’t already have one, you can get a copy of this form from your county assessor. It is possible to email or electronically submit the form for the Office when you’ve finished it. Illinois Resale Tax Exempt Form.

Official document of Contractor’s Exemption

To buy constructing items that are exempt from revenue taxation, building contractors in the state of Illinois must have a Contractor’s Exemption Certificate taxation exemption develop. A certification applies to the task it names along with the contract’s stated importance. A new exemption certificate would be necessary if you got a new contract. You must give your subcontractor a copy of your exemption certificate if you’re working with one in the state of Wisconsin.

Quasi-federal government

One particular type of quasi-authorities institution is really a research and development center backed by the government. To meet a federal will need, these companies blend aspects of the general public and individual sectors. National labs have been produced in the course of The Second World War as hybrid establishments that obtained govt credit but have been secretly operate by non-national agencies. Simply because these particular agencies were actually exempt from standard management and civil services norms, these people were astonishingly effective in the conflict.

Armed services member

You can be eligible for a federal tax exemption if you are a member of the military and have served in a combat area. The exception can mean a lot. You could possibly save as much as $2,000 a year in federal taxes due to the tax exemption. But keep in mind that because Social Security and Medicare taxation are not exempt, military salary is not taxation-totally free. So it’s crucial to fill out a tax exemption form.

MIT

You might have to submit a tax exemption form if you have the status of a foreign national. Through the Sprintax Tax Determination Process, you can make this happen. You can decide to have your national and status income taxes withheld by accomplishing the Atlas kind. At the start of your consultation, you need to then provide the form to MIT. Employees at MIT must also send their earnings towards the Internal revenue service. Contact MIT’s payroll office if you’re unsure if tax withholding applies to you.

Internal revenue service determination letter from MIT

According to the IRS determination letter an organization is granted federal tax exemption. Without it, the section of earnings can only unconditionally take Type G-6. A conditional authorization, nevertheless, may be changed right into a long lasting exemption. The organization’s taxes-exemption app should therefore incorporate MIT’s Internal revenue service willpower note for taxation exemption develop. If MIT is granted tax-exemption in the IRS determination letter, it is obvious that the organization’s tax-exempt status is secure.

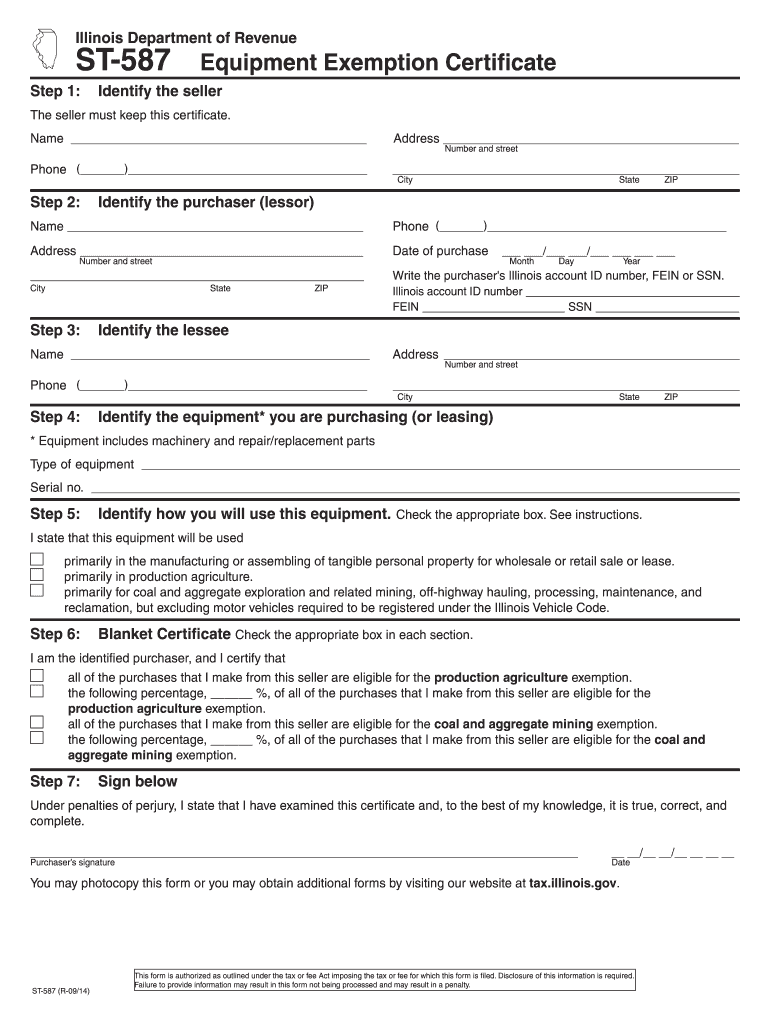

Farm equipment that is certainly not exempt

If you are leasing or buying agricultural machinery, you might not be aware of the tax exemption on farm equipment. According to the IRS, agriculture is the raising and harvesting of any commodity. It entails increasing hens, dairy products cows, and in many cases molluscan shellfish. However, people who are involved in the purchase and selling of agricultural products are not regarded as those who produce agriculture. You can still buy farm machinery that is eligible for a tax exemption permit, though.

Agriculture-connected goods

Numerous gardening products fit into the tax-exempt category. Included in this are gardeningequipment and livestock, and plants. It is possible to request tax exemptions on these matters using the FS-1053 kind. If you sell or lease agricultural equipment, you must submit a tax exemption form. Moreover, there is no income taxation on these items. For many things which aren’t regarded as agricultural items, a tax exemption type is offered.

creating supplies

Learning the requirements for a development fabric tax exemption type is crucial while building a house. Design supplies are concrete items of individual house that happen to be found in building buildings or generating land upgrades. When they are merged in to the actual real property, these factors are no more recognizable as individual home. These materials and supplies involve these utilized in construction and landscaping. Equipment used for warehousing, including laptop or computer methods, racking solutions, and promoting products, is furthermore free from design material tax.

warehousing equipment

If you work in the industry of keeping products, a warehousing equipment tax exemption form is a necessary tool. Racking techniques, conveying techniques, and computer methods are some of these components of equipment. Did you realize that warehouse equipment is exempt from taxes, however? Having warehousing devices are helpful for several good reasons. Here are several cases: