Integrative Therapeutics Sales Tax Exemption Form – In order to be exempt from sales tax, an employee must be able to make sales. This is certainly commonly attained by making marketing transactions or assisting one more employee shut bargains. The employee should, even so, take part in unbiased income endeavours. Moreover, the exterior sales exemption only is applicable to workers who perform company away from the company’s amenities, such as at business shows. Or else, a third party income exemption record needs to be introduced with the staff. Each and every time a staff member engages in outdoors income action, this form is needed. Integrative Therapeutics Sales Tax Exemption Form.

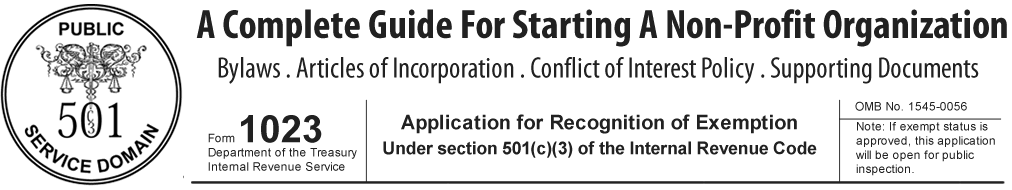

Income taxation will not be applicable to low-revenue agencies.

A 501(c)(3) non-profit business is typically exempt from having to pay product sales taxes, yet it is not exempt from getting or remitting it. However, the nonprofit organization is permitted to sell taxable goods without collecting sales tax as long as it complies with specific standards. Tangible personal residence is really what nonprofit agencies can offer that is taxable. Not-for-profit businesses need to match the condition-certain standards for exemption.

In order to qualify as a nonprofit, the organization needs to fulfill a number of criteria, such as purpose, payment, and purchase quantity. Income taxation exemptions for nonprofits ought to be wanted inside their house status as well as any nearby says. Achieving sales-tax exemptions in many suggests, such as using the Streamlined Income and make use of Taxes Agreement Official document of Exemption, may also be advantageous for nonprofit businesses. Nonprofits ought to, nonetheless, constantly be aware of the limitations added to income-income tax exemptions.

Income tax is not really put on on-line vendors.

According to a recent survey, the majority of internet sellers are free from collecting sales tax, but the number of exemptions is rapidly rising. These exclusions offer small, regionally owned or operated companies a tremendous advantage to enable them to compete with large national shops. The profitability and competitiveness of small enterprises will suffer if these exclusions are eliminated. When compared with giant organizations, little enterprises are frequently more entrepreneurial and versatile when it comes to new technologies.

In fact, the Wayfair ruling puts a unique concentrate on on the internet marketplaces and mandates that they can collect product sales income tax off their next-celebration vendors. Numerous on the internet merchants, such as Amazon online, prevented this need for a long time prior to starting to fee income tax for your services and goods they have. Even with having physical places in many says, Amazon . com only accumulates income tax about the goods they sell directly to buyers. These retailers have to to very carefully analyze their business online approach and make sure the appropriate product sales taxation is now being compensated.

You must send Type ST-12.

When seeking a revenue taxes exemption, a legitimate certification of exemption is needed. If a purchase is made with the principal use in mind, a sales tax exemption may be requested. A tangible private item or service is said to be in its major use when it is utilized for at least 50% of the time. A revenue taxes exemption certification needs to be offered to the seller by the buyer of an exempt great or service. The owner is accountable for providing facts.

A firm can request a tax exemption certificate, by submitting Form ST-12. In order to withdraw it if the company is no longer eligible for the sales tax exemption, the seller is required to give the vendors the form. The utilization of exemption use certificates is governed by Massachusetts Legislation (830 CMR 64H.8.1). If an exemption certificate is knowingly misused, criminal consequences may apply. A firm could deal with the two civil and criminal penalties for deliberately breaking up this rule.

The certificate’s five-year expiry day

Virtually all folks are oblivious that certifications expire after 5yrs. Simply because they haven’t been utilized inside that period, they are not any longer apt to be genuine. In truth, it’s typical for a card or certificate to expire for more than ten years; therefore, if you want to continue using it, you must obtain a new one. You are protected from this circumstance by the law. That’s the good news.

As soon as your qualification is due to expire, SSL official document service providers give notices with their circulation details. When your certificate comes up for renewal, your Point-of-Contact might not be available,. That is the issue. In fact, if the qualification runs out, you could possibly obtain a promotion or get fired. Fortunately, by making use of these tactics, you could possibly stay out of this predicament. You could extend the lifestyle of your own SSL qualification with such easy suggestions.