Los Angeles County Recorder Exemption Form 75 – How should a state exemption kind be completed? There are a the occasional points you need to know before you start. The requirements for using and the due dates are explained in this post. If you’re thinking about submitting an exemption application, to ensure the process goes as smoothly as possible, keep these suggestions in mind. The cost savings you’ll realize once you do will astound you. Although guaranteeing that your area is provided with a lot more authorities money, you’ll be able to keep more cash in your wallet. Los Angeles County Recorder Exemption Form 75.

Receiving Region Exemptions

You must first submit an Application for County Exemptions in order to be granted an exemption for your property. Six copies of this form needs to be finished in its entirety. Your application can be submitted at any time of the year, although it is advised that you do so as soon as feasible. This can guarantee that exist the necessary exemption. You should be aware that any taxing power could competition your exemption. As a result, it’s crucial to adhere to all filing dates.

You have to charm the denial of your exemption. This attraction carries a 30-day submitting time frame. You must send an appeal to the worth Modification Board following simply being declined. You must also include any assisting paperwork for your assert. In the ability to hear, the Property Appraiser may also be current. You have to document a court action in circuit the courtroom when the VAB policies in your attractiveness. You will find a $15 submitting cost.

Circumstances for applying

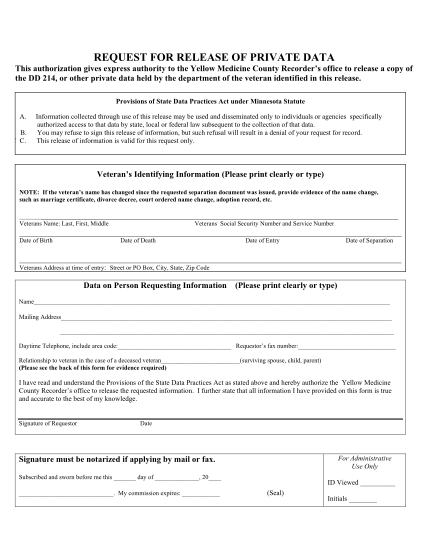

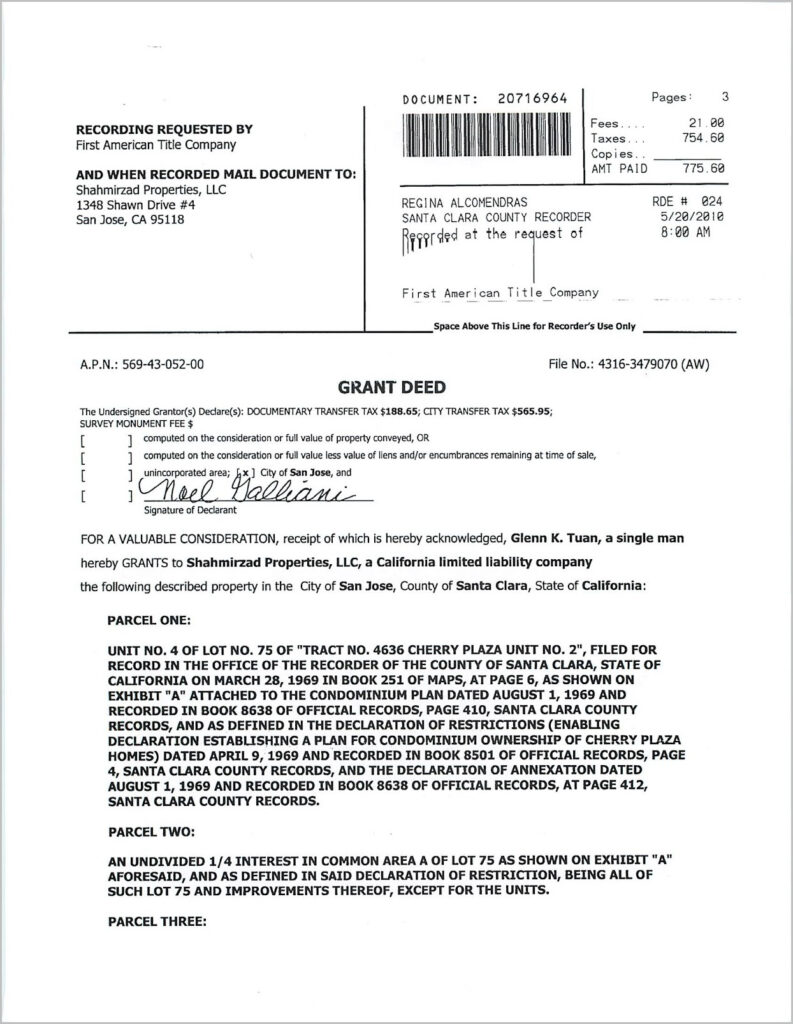

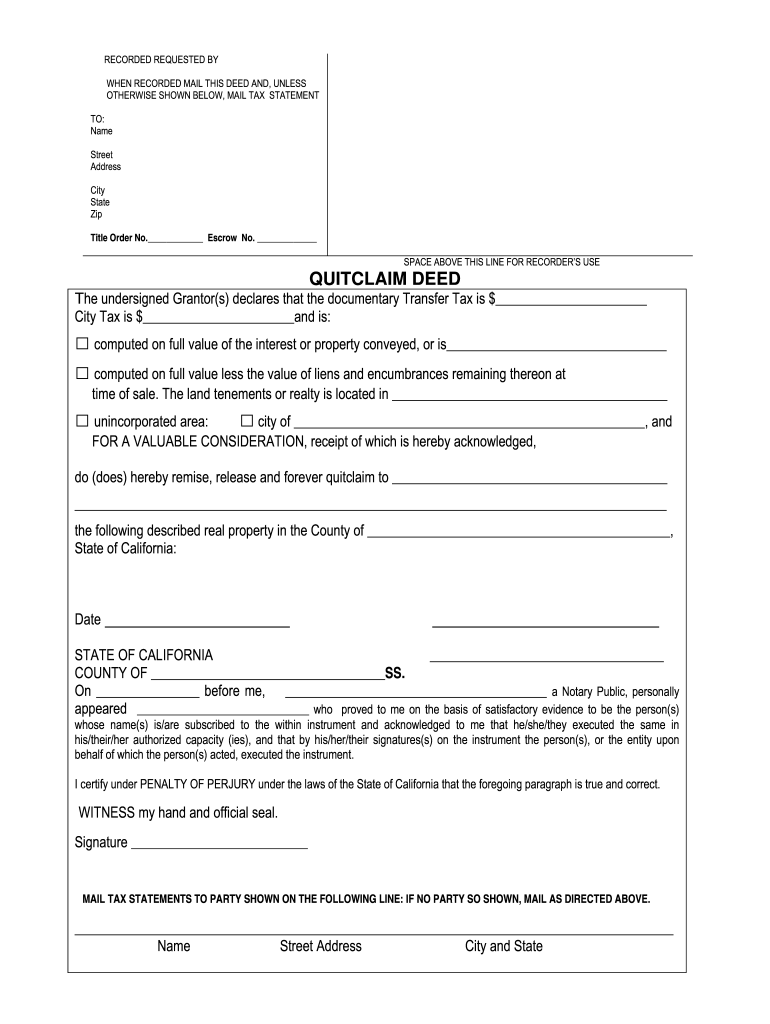

Review the eligibility conditions first before submitting the application. All candidates are required to submit their Social Security Numbers as well as, if relevant, the numbers of any spouses. All applicants also need to present ownership records, like a noted deed or a taxation monthly bill from Lee State. If you own the property through a trust, a copy of the trust document and documentation proving your authority to make decisions for the trust are required. Any trustees you may have in the house also needs to indication the applying within their potential as trustee.

You must make a certain amount of cash to qualify for an exemption. You can qualify for a homestead exemption if your household has a high income. You must be 62 years old or older to be eligible, although homeowners who meet the requirements can receive homestead exemptions. Home owners 62 several years of several years and older can also be exempt from some additional fees. If you are eligible for one of these programs, you might not be required to pay any property taxes.

Conditions for filing

Knowing the filing standards is vital when asking for a homestead exemption. According to California law, homeowners who meet the qualifications might earn a $7,000 reduction in their assessed worth. In order to qualify, the house must have been the owner’s primary residence as of the lien date. Homeowners need complete the BOE-266 form, which can be obtained from the county assessor’s office, in order to file. First, no later than February 15; the form must only be submitted once, although time candidates can submit the form whenever they become eligible.

You have to own the home and also be 65 years of age or older to qualify for the Above 65 exemption. The only real owner or tenant in the property needs to be you. The property need to serve as your main home. You might send an application whenever you want once you transform 65. You should also current documentation of your residency and age. To demonstrate your eligibility, you need to have a condition-issued Identification. The application is only accepted if you have all the necessary paperwork on hand.

File-by schedules

Your property must fulfill certain requirements in order to be qualified for a tax relief. Most counties use a deadline in which applications for taxes exemptions has to be submitted. Before submitting if you are filing on someone else’s behalf because you will need to provide evidence that they will not be using the property, make sure you are aware of the deadline. Such as owning a home for a disabled person, many counties can grant you an additional tax relief, if you fulfill specific requirements. Requesting a tax exemption involves filling out documentation and paying a charge, typically. You can submit an exemption form on your own to request a tax reduction if you’re working with a tax expert.

Before submitting an application, candidates should confirm that they possess a valid Texas driver’s license and a DPS identification card. Moreover, they need to confirm the tackle on the ID and also the a single on their own application are exactly the same. If you’re unsure whether your home qualifies for an exemption, you can contact the Fort Bend Central Appraisal District to learn more about filing requirements. You must also be aware that the May fifteenth due date has gone by for submitting a company individual property form.

finishing the form

Filling in the county exemption kind may be challenging, whether you’re looking for a residential exemption or a business exemption. You must first choose the appropriate exemption type for you in order to begin. Up coming, ascertain the income tax years that you are certified to the exemption. Your application will probably be denied or not taken into consideration if you don’t fulfill all of these standards.

Even if they don’t live in the property, the majority of taxpayers are required to submit an application to their assessor in order to claim an exemption. Property owned by the state of Minnesota doesn’t need to, though others are required to file every three years. You could at times be required to complete a distinct application. It is best to get advice from the state auditor’s office in these conditions.