Ma Sales Tax Exempt Form St-5 – In order to be exempt from sales tax, an employee must be able to make sales. This is certainly frequently achieved through making promotional buys or helping an additional staff shut offers. The employee should, nevertheless, take part in independent revenue efforts. Moreover, the outer revenue exemption only is applicable to workers who conduct company out of the company’s amenities, including at industry shows. Normally, an outside revenue exemption document needs to be offered with the worker. Every time a staff member engages in outside product sales exercise, this type is needed. Ma Sales Tax Exempt Form St-5.

Revenue tax is not really appropriate to no-revenue businesses.

A 501(c)(3) charity company is normally exempt from having to pay sales taxation, yet it is not exempt from gathering or remitting it. However, the nonprofit organization is permitted to sell taxable goods without collecting sales tax as long as it complies with specific standards. Real personal residence is exactly what charity companies can offer that is certainly taxable. Nonprofit businesses must fulfill the condition-distinct criteria for exemption.

In order to qualify as a nonprofit, the organization needs to fulfill a number of criteria, such as purpose, payment, and purchase quantity. Product sales taxes exemptions for nonprofits ought to be required within their residence state as well as nearby states. Getting sales-taxation exemptions in several suggests, such as together with the Efficient Income and make use of Income tax Contract Certificate of Exemption, can be advantageous for not for profit businesses. Nonprofits should, even so, constantly know about the restrictions added to revenue-income tax exemptions.

Revenue taxes is not really used on on the internet retailers.

The majority of internet sellers are free from collecting sales tax, but the number of exemptions is rapidly rising, according to a recent survey. These exclusions supply modest, locally owned or operated enterprises a significant edge to allow them to contest with huge nationwide retailers. If these exclusions are eliminated, the competitiveness and profitability of small enterprises will suffer. Compared to massive businesses, modest businesses are frequently more entrepreneurial and versatile when it comes to new technological innovation.

In fact, the Wayfair judgment places a special focus on online marketplaces and mandates which they collect sales tax from the thirdly-celebration merchants. A lot of on the web sellers, which includes Amazon . com, prevented this require for a long time before you start to fee revenue taxation for your services and goods they provide. Despite having bodily places in certain claims, Amazon only collects revenue taxes about the merchandise they offer directly to consumers. These vendors must to carefully look at their web business approach and make sure the proper sales tax will be paid.

You must distribute Type ST-12.

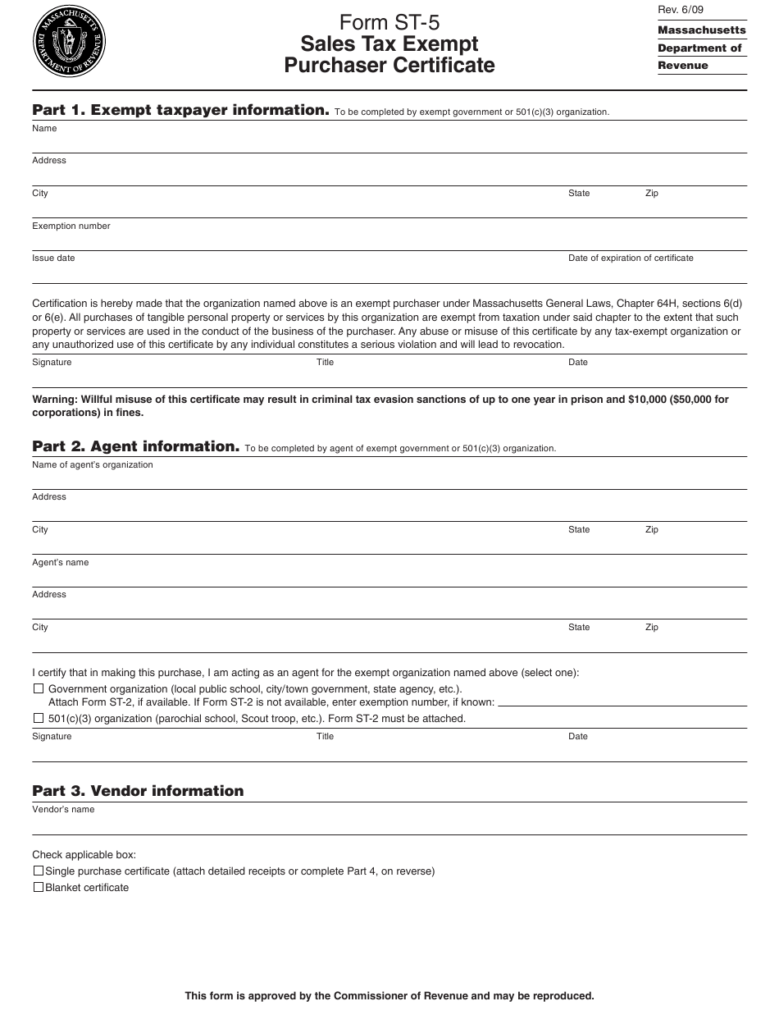

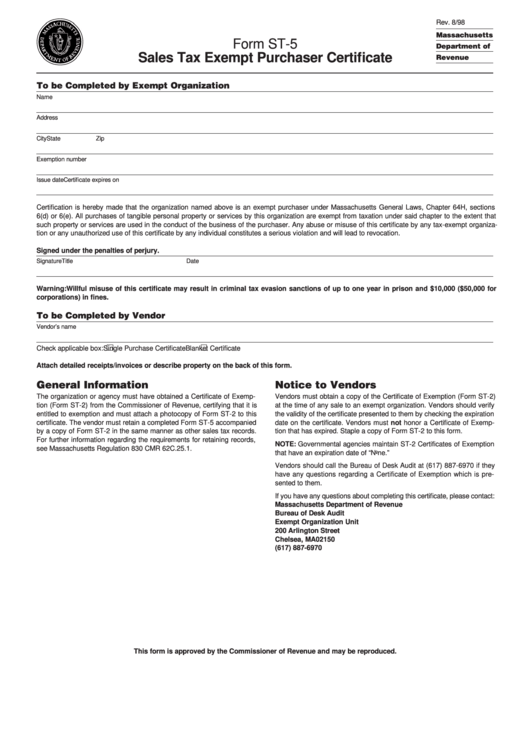

When requesting a revenue income tax exemption, a valid certification of exemption is essential. If a purchase is made with the principal use in mind, a sales tax exemption may be requested. A tangible personal product or services are said to be within its primary use after it is employed for about 50Per cent of times. A income tax exemption qualification must be presented to the seller with the buyer of your exempt very good or services. The seller accounts for delivering data.

By submitting Form ST-12, a firm can request a tax exemption certificate. The seller is required to give the vendors the form in order to withdraw it if the company is no longer eligible for the sales tax exemption. The utilization of exemption use certificates is ruled by Massachusetts Control (830 CMR 64H.8.1). Criminal consequences may apply if an exemption certificate is knowingly misused. A firm could deal with equally civil and criminal charges for deliberately breaking this rule.

The certificate’s five-calendar year expiration particular date

The vast majority of people are ignorant that certifications expire soon after 5 years. Because they haven’t been applied within that period, they are no longer probably going to be reputable. In truth, it’s typical for a card or certificate to expire for more than ten years; therefore, if you want to continue using it, you must obtain a new one. The good news is that you are protected from this circumstance by the law.

When your certificate is due to expire, SSL certificate suppliers send notices to their distribution listings. The issue is that when your certificate comes up for renewal, your Point-of-Contact might not be available. The truth is, if the qualification expires, you might get yourself a campaign or get fired. Fortunately, by utilizing these strategies, you could possibly stay out of this predicament. You may lengthen the life span of your respective SSL certificate utilizing these simple tips.