Mn Sales Tax Exemption Form St3 – In order to be exempt from sales tax, an employee must be able to make sales. This can be frequently completed if you make promotional buys or assisting one more employee shut deals. The worker should, however, embark on independent income endeavours. Moreover, the exterior product sales exemption only relates to personnel who perform business out of the company’s amenities, including at trade exhibitions. Or else, an outside sales exemption document must be presented with the worker. Each time an employee engages in outside the house revenue exercise, this particular type is necessary. Mn Sales Tax Exemption Form St3.

Income income tax is not really appropriate to no-profit agencies.

A 501(c)(3) non-profit firm is generally exempt from having to pay sales tax, yet it is not exempt from gathering or remitting it. However, the nonprofit organization is permitted to sell taxable goods without collecting sales tax as long as it complies with specific standards. Tangible individual home is what not for profit organizations can offer that is certainly taxable. Not-for-profit agencies have to match the status-specific requirements for exemption.

In order to qualify as a nonprofit, the organization needs to fulfill a number of criteria, such as purpose, payment, and purchase quantity. Revenue tax exemptions for nonprofits should be requested inside their residence express and any nearby says. Getting product sales-income tax exemptions in lots of suggests, like using the Efficient Revenue and employ Income tax Contract Qualification of Exemption, can be beneficial for not-for-profit companies. Nonprofits should, nonetheless, constantly be familiar with the restrictions placed on income-tax exemptions.

Income taxation will not be applied to on the internet sellers.

The majority of internet sellers are free from collecting sales tax, but the number of exemptions is rapidly rising, according to a recent survey. These exclusions offer small, locally owned enterprises an important edge so they can compete with huge nationwide retailers. The competitiveness and profitability of small enterprises will suffer if these exclusions are eliminated. When compared with massive organizations, modest enterprises are usually far more entrepreneurial and flexible with regards to new technological innovation.

In actuality, the Wayfair ruling sets a unique increased exposure of online marketplaces and mandates which they acquire product sales taxation from the 3rd-party vendors. A lot of on the internet merchants, including Amazon . com, avoided this need to have for quite some time before beginning to charge sales taxation for that services and goods they provide. In spite of experiencing bodily spots in some states, Amazon online only collects sales taxes about the items they offer directly to consumers. These sellers should to cautiously look at their online business technique and ensure how the proper revenue taxation will be paid for.

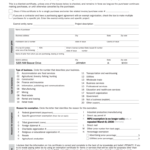

You should distribute Kind ST-12.

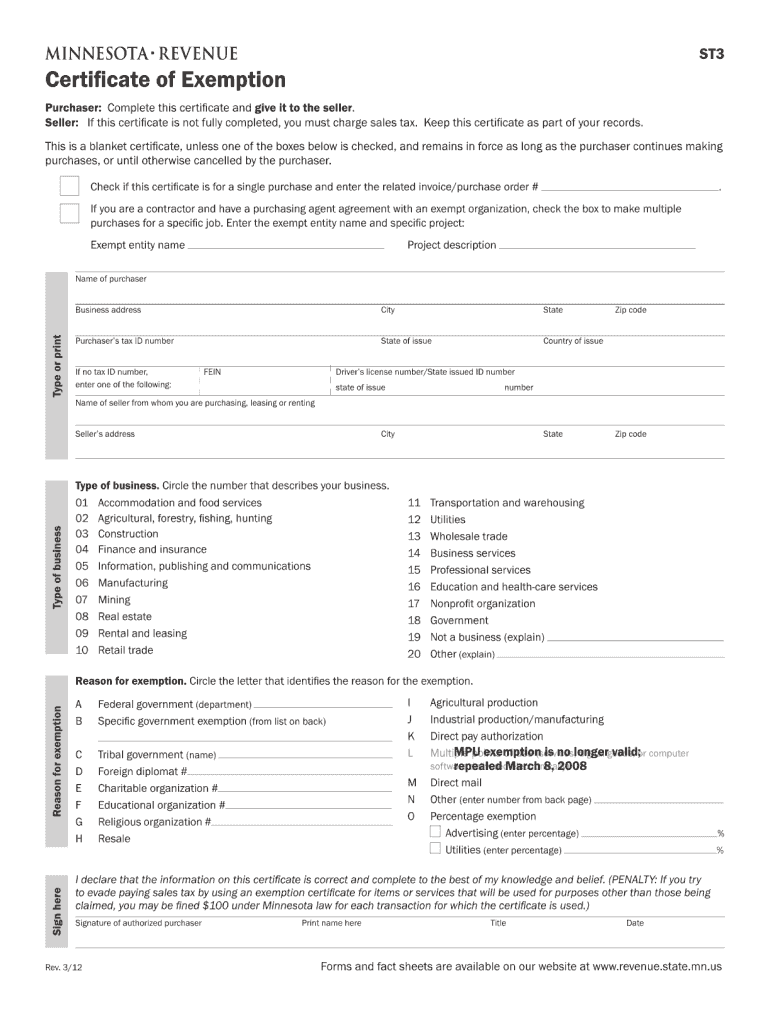

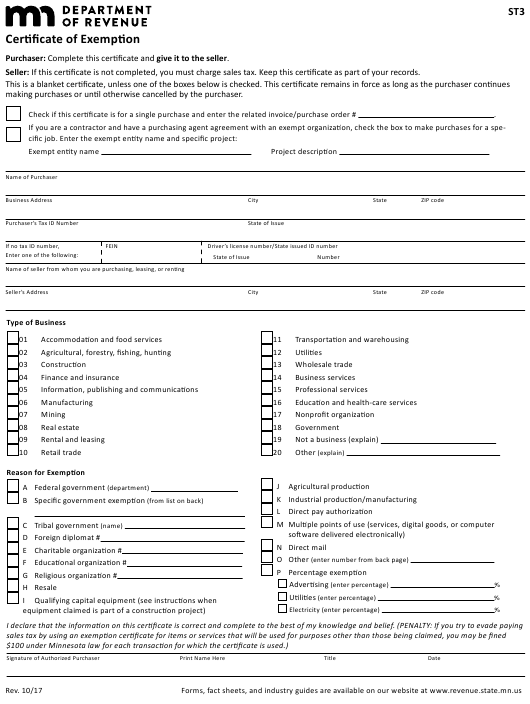

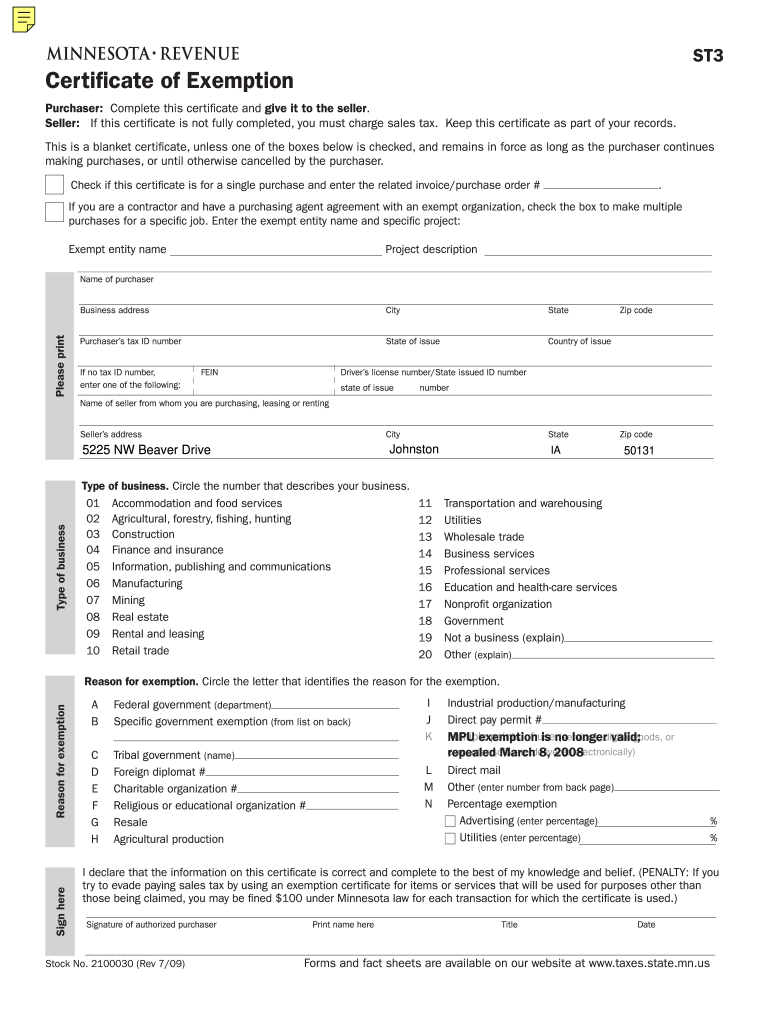

When requesting a product sales taxes exemption, a real certification of exemption is important. If a purchase is made with the principal use in mind, a sales tax exemption may be requested. A tangible individual product or services are said to be in their principal use after it is used for about 50Percent of times. A revenue taxes exemption certification has to be offered to the seller from the purchaser of the exempt very good or assistance. The vendor accounts for offering facts.

A firm can request a tax exemption certificate, by submitting Form ST-12. In order to withdraw it if the company is no longer eligible for the sales tax exemption, the seller is required to give the vendors the form. The usage of exemption use accreditation is controlled by Massachusetts Control (830 CMR 64H.8.1). Criminal consequences may apply if an exemption certificate is knowingly misused. A business could experience each criminal and civil penalties for deliberately breaking this rule.

The certificate’s several-year expiry time

The vast majority of individuals are ignorant that certifications expire soon after five-years. Given that they haven’t been employed in that point, these are no longer apt to be genuine. In truth, it’s typical for a card or certificate to expire for more than ten years; therefore, if you want to continue using it, you must obtain a new one. The good news is that you are protected from this circumstance by the law.

When your certificate is a result of expire, SSL official document suppliers give notifications for their syndication details. The issue is that when your certificate comes up for renewal, your Point-of-Contact might not be available. In fact, as soon as the certificate runs out, you could obtain a campaign or get fired. Luckily, by using these techniques, you may avoid this situation. You may extend the lifespan of your SSL qualification by using these effortless recommendations.