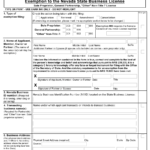

Nevada State Business License Exemption Form – To get tax-exempt whilst offering services or goods, you must distribute a Condition Exemption Develop. Applying online is the most popular one, even though there are other ways to get this form. The procedure can be confusing if you accomplish’t know what to glimpse for. Below are the specifications to get a certification, along with a couple of illustrations. To start appropriately submitting the form, make sure you are aware about exactly what it calls for. Nevada State Business License Exemption Form.

reductions in revenue taxes

A certification exempting a company from collecting and remitting sales taxation is actually a revenue taxes exemption qualification. For a few forms of transactions, like these manufactured by the us government or nonprofit organizations, exemption accreditation will be required. Sales tax is not applied to nontaxable items, although vendors are still required to maintain their exemption documents. Some items are excluded from sales income tax, therefore before publishing a sales taxes, you ought to confirm that the obtain is exempt.

Depending on the sort of home sold, some says have quite various revenue income tax exemptions. The vast majority of claims respect some items as requirements and offer exemptions in line with the piece. These things include such things asfood and clothes, and prescribed drugs. Claims that do not fully exempt a number of merchandise typically have decrease taxation costs. Cv studying to discover far better regarding your state’s income tax exemptions. Here are several valuable information and facts to help you out be sure you don’t lose out on rewarding taxation benefits.

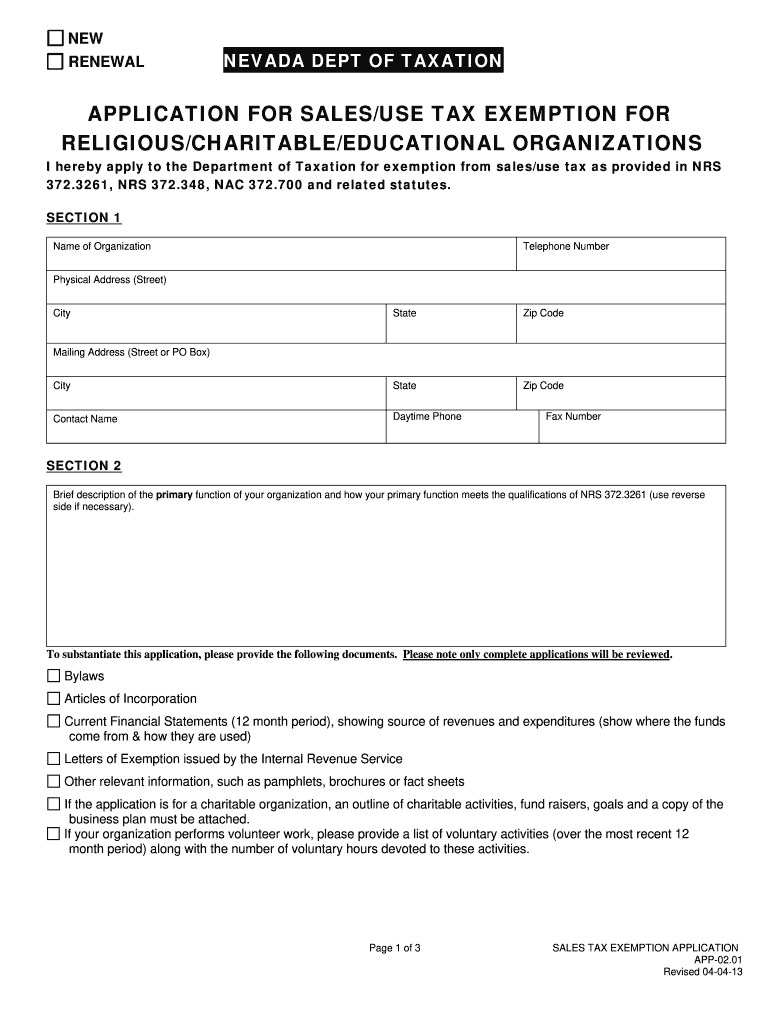

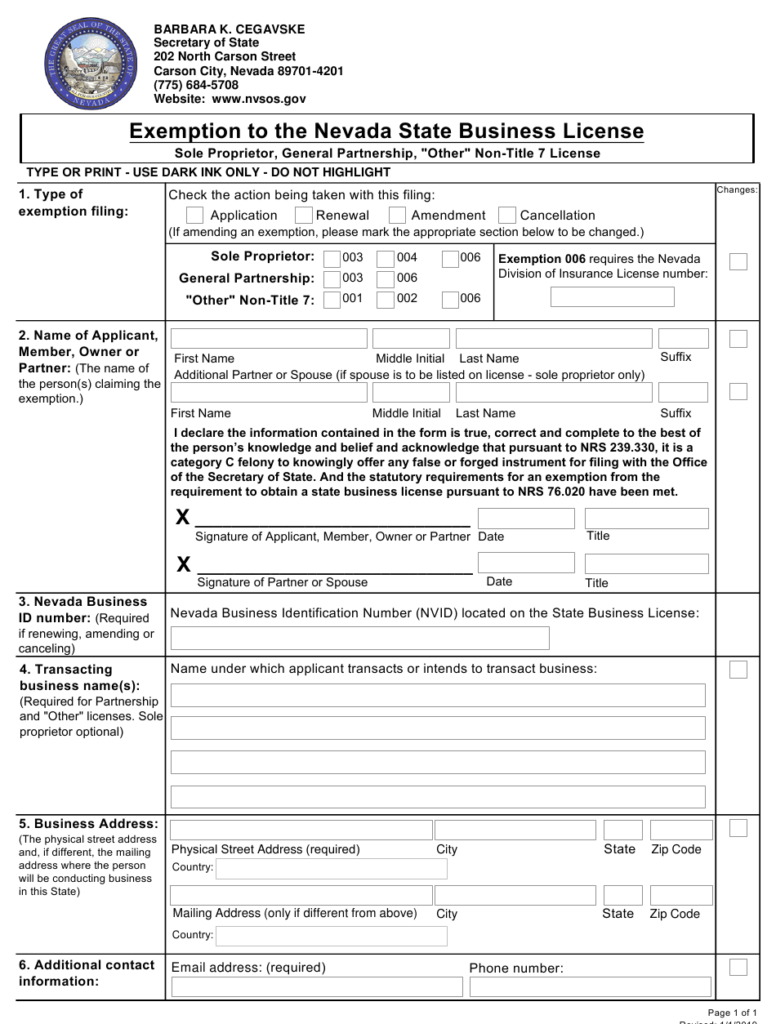

Demands

You will find specific must fill in your status exemption kind, whether or not you’re selling a product or service on-line or maybe in your real store. The exemption develop is provided from the Vermont Department of Taxation. This particular type should besigned and completed, and employed simply for the stipulated cause. Additional assisting info may be required about the develop to indicate the property’s exemption. This particular type may be acceptable in a couple of legal system depending on the condition.

You should publish distinct documentation when asking for an exemption, such as an invoice and a revenue fall. For instance, you must file a “Multiple Purchase” certificate if you are selling tangible personal property. Moreover, you’ll want a recent Certification of Influence. If you sell to numerous states, these documents may be able to save you from having to pay sales tax. When the documents has become submitted, you will be eligible to prevent paying product sales taxation.

Good examples

Samples of condition exemption varieties are crucial for small enterprises who attempt to avoid spending product sales tax. Many transactions can be made making use of this sort of paper. There are several exemption certificates, but they all call for the same fundamental data. No in the exemption, this business operator should preserve an updated certificate. Samples of state exemption types are proven below. Continue reading to understand more about them. You power be amazed at how simple it is to apply them to economize!

The selling of products to most people for non-industrial good reasons is one type of state taxation exemption. This tax crack is intended to promote the two standard welfare along with a specific market. A production line, as an illustration, might be excluded from paying out product sales income tax on items employed to make the completed item. This could relate to the tools and machines the company makes use of to produce the best. These purchases will encourage the firm to avoid spending revenue income taxes.

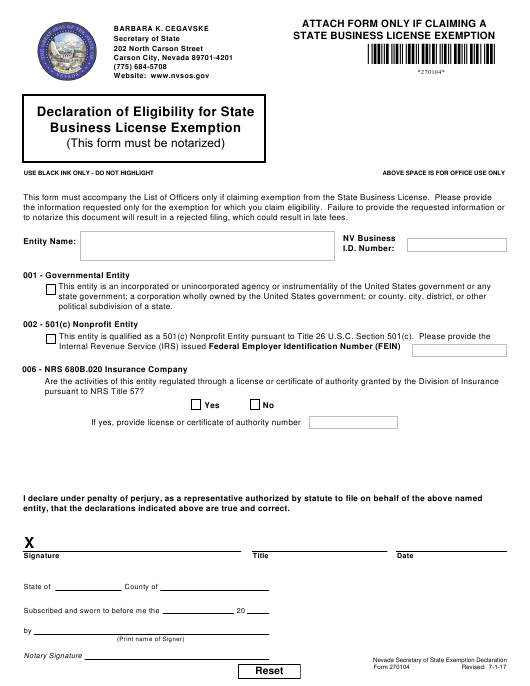

Circumstances to obtain a official document

In order to get a certificate of state tax exemption, an organization must complete a tax exemption form. An institution or government body that is exempt from sales income tax need to provide you with the information on the kind. Portion 2 of your form must be filled out from a 501(c)(3) entity or through the authorities. In order to conduct business, additionally, it must use the goods or services it has purchased. This qualification is at the mercy of tight limitations, and using it inappropriately may lead to its cancellation.

There are various sorts of certificates which can be used to obtain a sales taxes exemption. Some are approved at an on-line retailer and given electronically. Each and every express features its own pair of regulations for obtaining these files. If you are selling taxable property in New York, in general, a valid Certificate of Authority is required. However, a certificate of exemption issued by another state or another nation cannot be applied to the New York State sales tax.

Criteria to meet in order to acquire an exemption certificate

You need to also look at the certain requirements for a particular enterprise when selecting the appropriate state taxes level. They must in order to avoid having to do so, although for instance, a company selling widgets may not be required to collect sales tax in Florida. However, if a company does not have a nexus with a state, several states do not compel them to pay sales tax. With this situation, the organization is necessary to get an exemption qualification from the express through which they carry out organization.

A creating contractor also can acquire building materials for the venture for the taxes-exempt company having an exemption official document. The General Contractor must submit an application for a trade name and license in order to obtain a copy of an exemption certificate. Before hiring subcontractors, a building contractor must have the certificate. The state’s Secretary of State’s Organization Centre is how the contractor must also distribute an application for a business brand license. Design commitments with tax-exempt organizations’ exemption certifications, along with the renewal and signing up of buy and sell names, are handled by the Secretary of Condition Business Centre.