New Jersey Reciprocal State Exemption Form – To become taxes-exempt while marketing services or goods, you must send a Status Exemption Form. There are other ways to get this form, but applying online is the most popular one. If you accomplish’t know what to glimpse for, the procedure can be confusing. Under are among the prerequisites for the certification, in addition to a number of images. To begin properly completing the form, ensure you are mindful of what it needs. New Jersey Reciprocal State Exemption Form.

special discounts in sales fees

A certification exempting a company from collecting and remitting sales fees is actually a income taxes exemption official document. For several forms of buys, for example these created by the federal government or charity companies, exemption accreditation are needed. Vendors are still required to maintain their exemption documents, though sales tax is not applied to nontaxable items. Some merchandise are excluded from income taxes, therefore prior to publishing a income tax return, you need to verify that the purchase is exempt.

In line with the form of home sold, some claims have very distinct income taxation exemptions. Virtually all states reverence some merchandise as needs and allow exemptions in line with the piece. These things include stuff likeclothes and food, and medications. Says that do not completely exempt certain items typically have reduced taxes rates. Cv studying to discover far better relating to your state’s product sales taxation exemptions. Below are a few valuable information to help you out make sure you don’t lose out on beneficial taxes advantages.

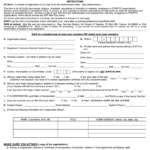

Specifications

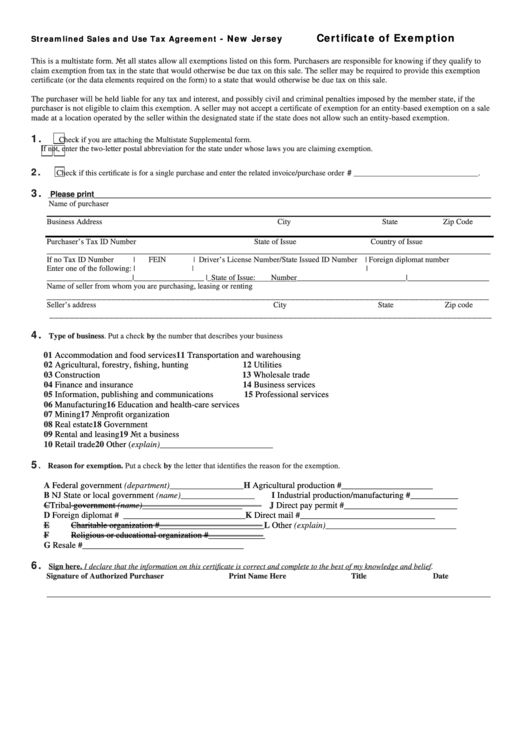

You can find specific needs to complete your condition exemption form, regardless of whether you’re promoting a product or service on-line or perhaps in your actual shop. The exemption kind is supplied with the Vermont Section of Income taxes. This type should besigned and completed, and utilized only for the stipulated explanation. Extra assisting details may be needed about the form to indicate the property’s exemption. This form may be acceptable in a couple of authority dependant upon the express.

You must publish particular documents when requesting an exemption, which includes an invoice along with a sales slip. For instance, you must file a “Multiple Purchase” certificate if you are selling tangible personal property. Additionally, you’ll want a existing Qualification of Influence. If you sell to numerous states, these documents may be able to save you from having to pay sales tax. When the forms has become submitted, you will end up qualified for stay away from spending income tax.

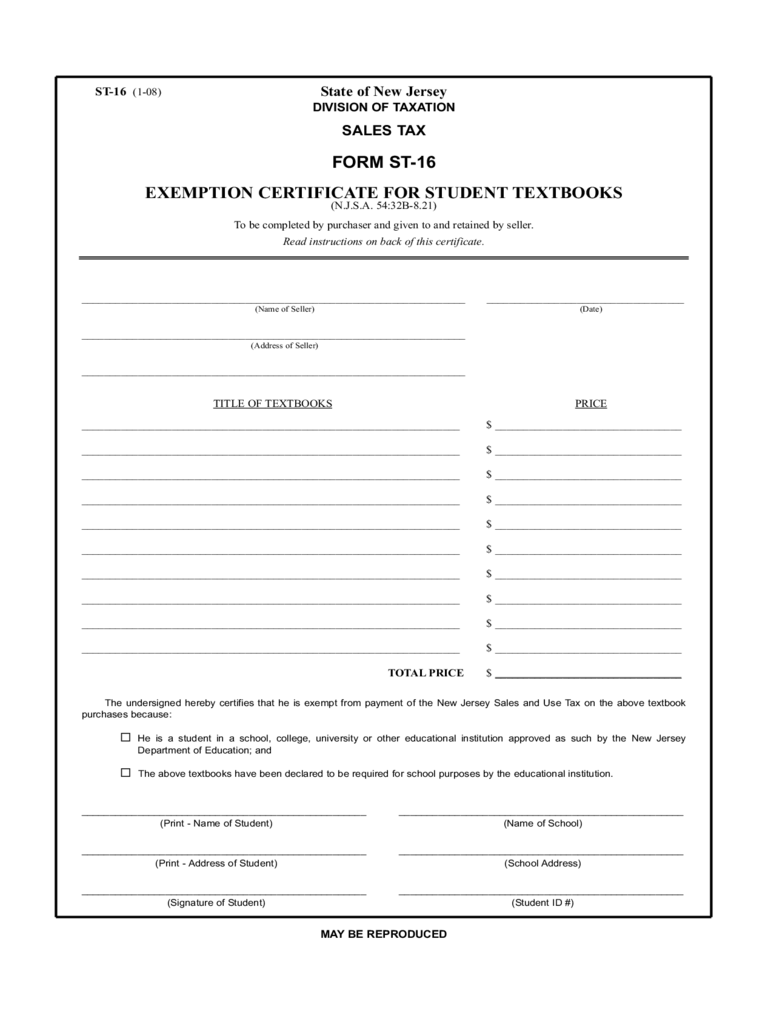

Good examples

Examples of express exemption varieties are essential for smaller businesses who seek to steer clear of paying income tax. Quite a few transactions can be created using these kinds of pieces of paper. There are several exemption certificates, but they all call for the same fundamental data. No of the exemption, this business operator should keep an updated certification. Types of status exemption varieties are shown beneath. Continue reading for more information on them. You potential be amazed at how simple it is to apply them to spend less!

The sale of commodities to most people for low-industrial reasons is a type of state tax exemption. This taxation crack is meant to market the common welfare as well as a distinct sector. A factory, for example, may be excluded from spending sales taxation on items accustomed to have the concluded item. This could apply to the machines and tools the maker uses to make the good. These acquisitions will enable the business to prevent spending product sales income taxes.

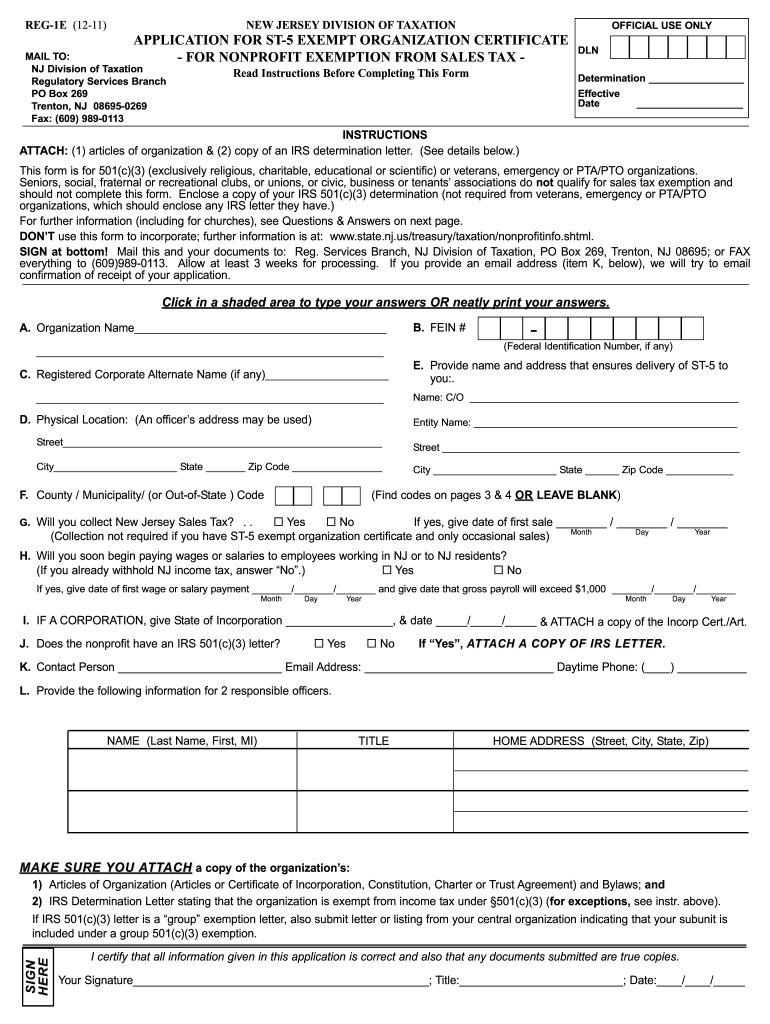

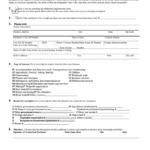

Circumstances to acquire a official document

In order to get a certificate of state tax exemption, an organization must complete a tax exemption form. An organization or governmental entire body that may be exempt from revenue taxation need to supply the info about the form. Portion 2 in the kind must be filled out by a 501(c)(3) organization or from the authorities. In order to conduct business, additionally, it must use the goods or services it has purchased. This official document is at the mercy of small constraints, and ultizing it improperly could lead to its cancellation.

There are numerous types of accreditations which can be used to have a income income tax exemption. Some are recognized in an on the internet shop and granted in electronic format. Every single state has its own pair of rules for acquiring these files. If you are selling taxable property in New York, in general, a valid Certificate of Authority is required. However, a certificate of exemption issued by another state or another nation cannot be applied to the New York State sales tax.

Criteria to meet in order to acquire an exemption certificate

You should also take into account the specific requirements for the company when deciding on the perfect status income tax price. They must in order to avoid having to do so, although for instance, a company selling widgets may not be required to collect sales tax in Florida. However, if a company does not have a nexus with a state, several states do not compel them to pay sales tax. Within this circumstance, the corporation is required to obtain an exemption qualification through the condition through which they conduct business.

A creating contractor may also get creating materials for the venture to get a taxation-exempt organization employing an exemption certification. The General Contractor must submit an application for a trade name and license in order to obtain a copy of an exemption certificate. A building contractor must have the certificate, before hiring subcontractors. The state’s Secretary of State’s Organization Middle is the place where the contractor also needs to submit a software for the business name certification. Building deals with tax-exempt organizations’ exemption accreditation, and also the renewal and sign up of industry labels, are managed from the Assistant of Status Enterprise Heart.