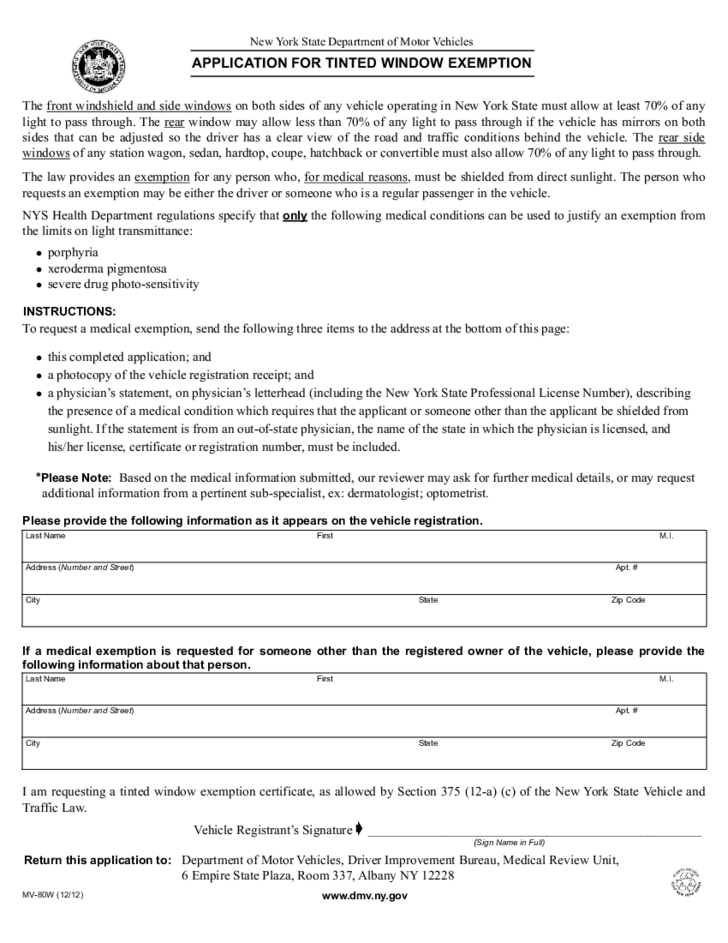

New York State Window Tint Exemption Form – To become taxes-exempt although promoting services or goods, you need to distribute a Condition Exemption Develop. There are other ways to get this form, but applying online is the most popular one. If you accomplish’t know what to glimpse for, the procedure can be confusing. Beneath are some of the requirements for the certification, together with a couple of pictures. To start properly completing the shape, ensure you are aware of just what it demands. New York State Window Tint Exemption Form.

reductions in sales taxation

A official document exempting a business from collecting and remitting product sales taxes is actually a sales income tax exemption qualification. For some forms of acquisitions, like all those made by the us government or nonprofit organizations, exemption accreditations are required. Sales tax is not applied to nontaxable items, although vendors are still required to maintain their exemption documents. Some goods are excluded from revenue taxation, hence before sending a product sales tax return, you ought to verify that the acquire is exempt.

Based on the form of residence marketed, some says have quite various product sales taxation exemptions. Nearly all states reverence some items as requires and grant exemptions in accordance with the piece. These matters include things such asclothes and food, and medications. Suggests which do not fully exempt a number of products routinely have lower taxation rates. Cv looking at to find out greater regarding your state’s sales income tax exemptions. Here are several useful details to assist you make sure you don’t lose out on useful taxation advantages.

Needs

You will find specific should complete your status exemption form, regardless of whether you’re promoting a product on the web or perhaps in your genuine retailer. The exemption form is supplied with the Vermont Section of Income taxes. This form should becompleted and signed, and applied just for the stipulated explanation. Additional helping details may be needed around the type to demonstrate the property’s exemption. This kind might be appropriate in a couple of authority based on the status.

You must publish particular paperwork when requesting an exemption, such as an invoice along with a income slip. For instance, you must file a “Multiple Purchase” certificate if you are selling tangible personal property. Moreover, you’ll require a existing Qualification of Influence. If you sell to numerous states, these documents may be able to save you from having to pay sales tax. Once the forms has become posted, you may be qualified to steer clear of paying out income taxation.

Illustrations

Examples of state exemption types are crucial for small enterprises who aim to avoid paying product sales tax. Quite a few acquisitions can be done using this kind of pieces of paper. They all call for the same fundamental data, even though there are several exemption certificates. No of your exemption, the company operator should sustain an updated qualification. Instances of condition exemption varieties are proven listed below. Continue reading for additional details on them. You strength be stunned at how easy it is to apply them to economize!

The sale of products to the general public for low-commercial motives is a sort of status taxes exemption. This tax bust is designed to advertise the two standard interest and a particular sector. A manufacturer, as an illustration, may be excluded from having to pay revenue taxes on materials used to make the finished product or service. This could pertain to the machines and tools the company utilizes to generate the best. These acquisitions will enable the company in order to avoid paying out revenue income taxes.

Circumstances to obtain a certification

An organization must complete a tax exemption form in order to get a certificate of state tax exemption. An institution or governmental physique that is exempt from revenue tax should supply the details in the develop. Component 2 from the type must be completed with a 501(c)(3) organization or by the government. Additionally, it must use the goods or services it has purchased in order to conduct business. This certificate is subjected to small limits, and making use of it improperly might lead to its cancellation.

There are several kinds of certificates which can be used to have a product sales taxation exemption. Some are recognized with an on the web retailer and given electronically. Every express possesses its own pair of guidelines for receiving these paperwork. In general, a valid Certificate of Authority is required if you are selling taxable property in New York. However, a certificate of exemption issued by another state or another nation cannot be applied to the New York State sales tax.

In order to acquire an exemption certificat, criteria to meete

You need to also consider the certain demands for a particular enterprise when picking out the appropriate state tax amount. They must in order to avoid having to do so, although for instance, a company selling widgets may not be required to collect sales tax in Florida. However, if a company does not have a nexus with a state, several states do not compel them to pay sales tax. In this particular case, the corporation is necessary to obtain an exemption qualification from your status through which they perform enterprise.

A building service provider may also acquire building supplies to get a project to get a taxation-exempt firm having an exemption certification. The General Contractor must submit an application for a trade name and license in order to obtain a copy of an exemption certificate. Before hiring subcontractors, a building contractor must have the certificate. The state’s Assistant of State’s Organization Middle is when the licensed contractor must also distribute an application to get a business brand certificate. Building commitments with income tax-exempt organizations’ exemption certificates, along with the renewal and enrollment of business names, are handled through the Secretary of State Enterprise Center.