Nj Sales Tax Exempt Form St-5 – In order to be exempt from sales tax, an employee must be able to make sales. This is certainly often attained simply by making promotional buys or aiding yet another worker close offers. The staff member should, however, embark on self-sufficient income attempts. Moreover, the outside income exemption only relates to workers who perform business out of the company’s services, like at industry displays. Otherwise, a third party income exemption document needs to be introduced by the employee. Each and every time a staff member engages in exterior income activity, this kind is essential. Nj Sales Tax Exempt Form St-5.

Product sales taxation is just not applicable to non-earnings organizations.

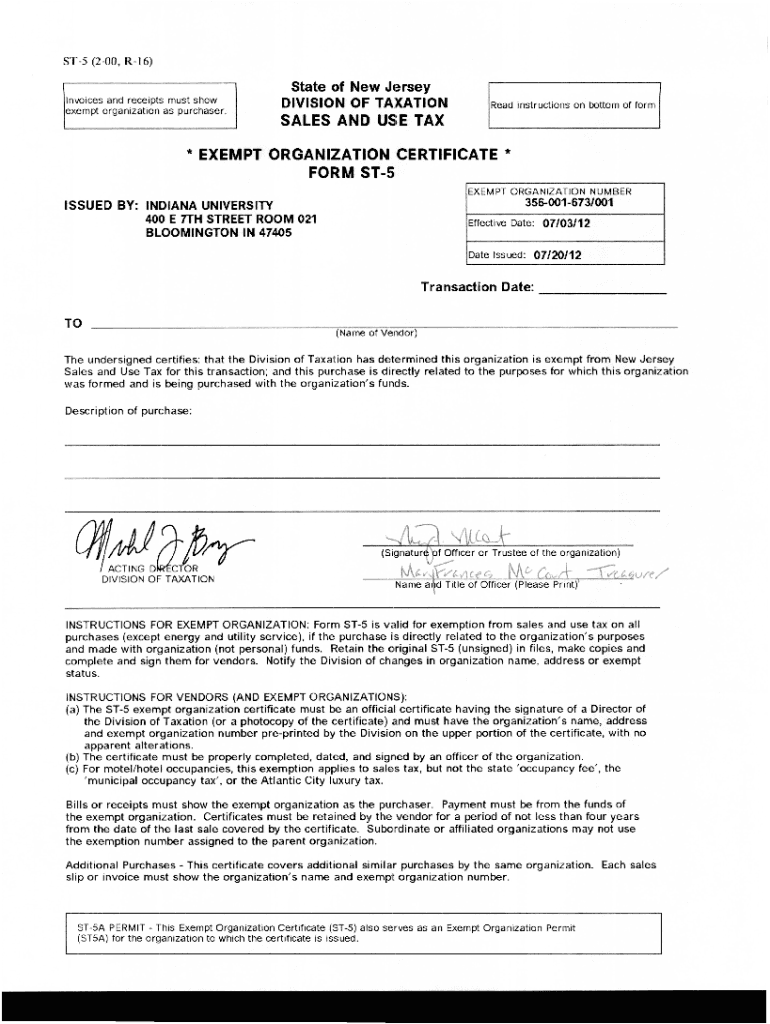

A 501(c)(3) non-profit firm is generally exempt from paying income taxation, yet it is not exempt from getting or remitting it. The nonprofit organization is permitted to sell taxable goods without collecting sales tax as long as it complies with specific standards, however. Perceptible personal property is what charity organizations can market which is taxable. Not for profit agencies must match the condition-certain specifications for exemption.

The organization needs to fulfill a number of criteria, such as purpose, payment, and purchase quantity, in order to qualify as a nonprofit. Product sales taxation exemptions for nonprofits must be asked for with their home condition as well as any nearby states. Achieving income-tax exemptions in lots of claims, like with the Sleek Revenue and Use Taxes Deal Qualification of Exemption, can also be beneficial for nonprofit organizations. Nonprofits ought to, nevertheless, always be aware of the limitations placed on product sales-taxation exemptions.

Sales taxes is not applied to on the internet sellers.

The majority of internet sellers are free from collecting sales tax, but the number of exemptions is rapidly rising, according to a recent survey. These exclusions provide small, regionally possessed organizations a substantial edge to allow them to take on major federal shops. If these exclusions are eliminated, the profitability and competitiveness of small enterprises will suffer. In comparison with giant businesses, modest enterprises are frequently more entrepreneurial and flexible in relation to new modern technology.

In actuality, the Wayfair judgment places a special focus on on the internet marketplaces and mandates that they accumulate sales taxation using their 3rd-party sellers. Several online sellers, which include Amazon online marketplace, averted this will need for a long time before starting to fee income tax for the goods and services they offer. Regardless of getting bodily places in certain states, Amazon online only gathers product sales taxation in the merchandise they sell straight to shoppers. These merchants must to very carefully look at their business online technique and ensure that the appropriate income income tax will be compensated.

You must distribute Kind Saint-12.

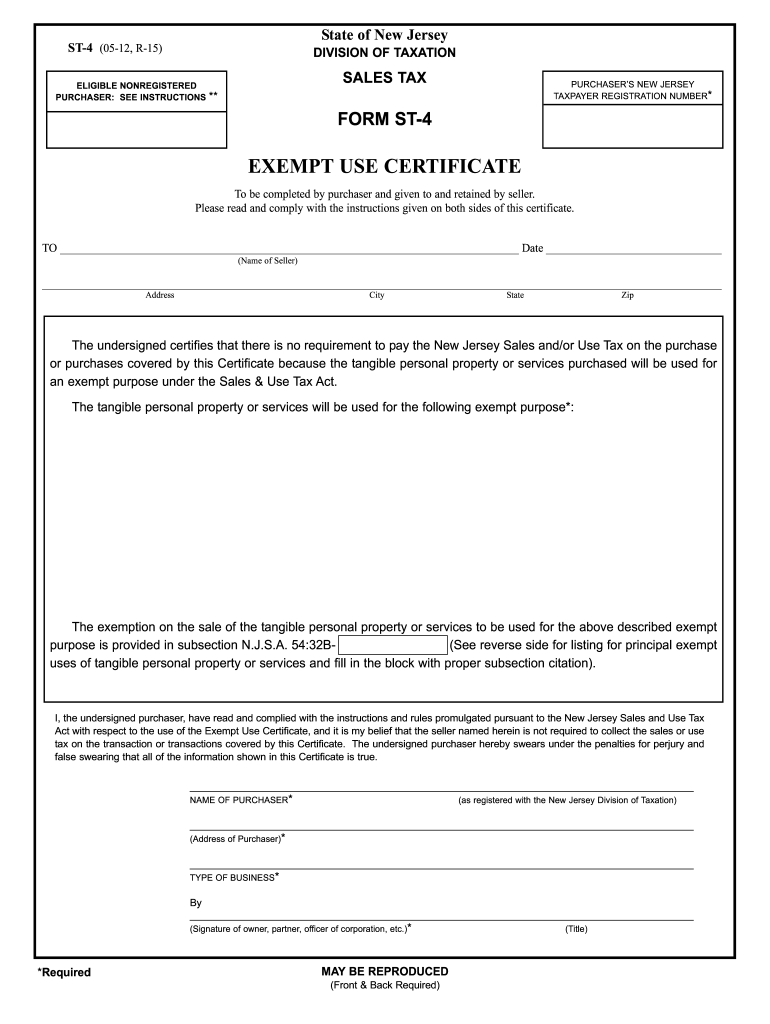

When requesting a income tax exemption, a legitimate official document of exemption is important. A sales tax exemption may be requested if a purchase is made with the principal use in mind. A concrete personalized piece or services are reported to be in its main use after it is used for at least 50Percent of times. A sales tax exemption official document needs to be provided to the owner by the purchaser of the exempt excellent or assistance. The seller accounts for providing facts.

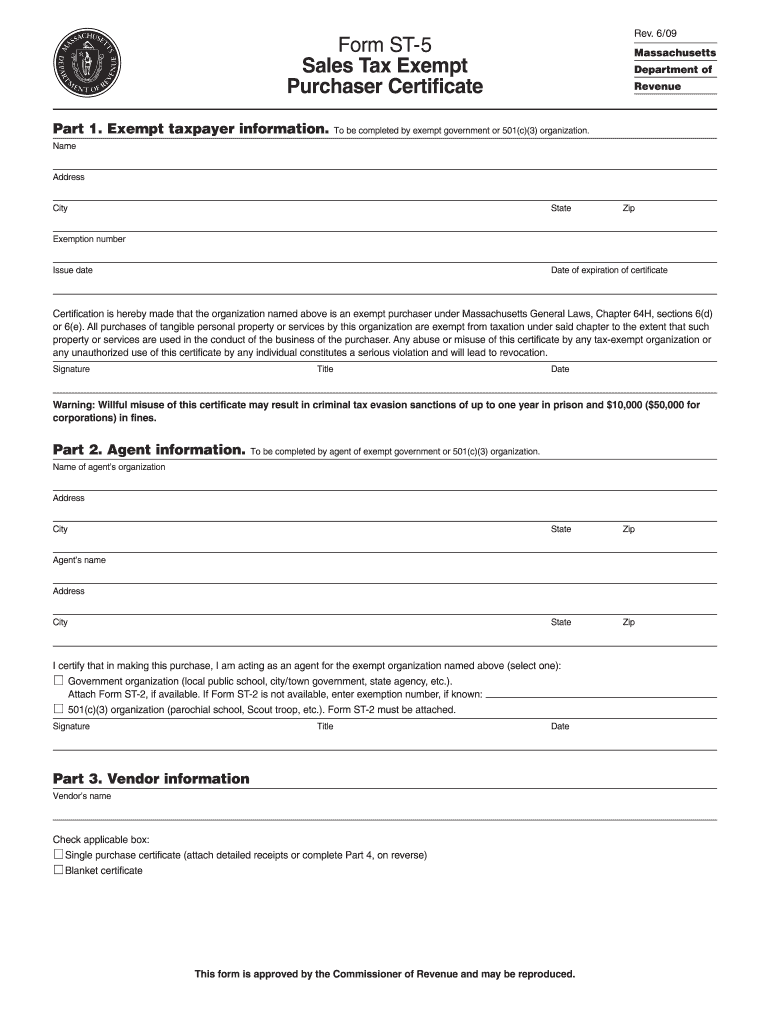

A firm can request a tax exemption certificate, by submitting Form ST-12. In order to withdraw it if the company is no longer eligible for the sales tax exemption, the seller is required to give the vendors the form. The usage of exemption use accreditation is governed by Massachusetts Regulation (830 CMR 64H.8.1). If an exemption certificate is knowingly misused, criminal consequences may apply. A firm could encounter each criminal and civil fees and penalties for deliberately breaking up this tip.

The certificate’s several-12 months expiry day

The majority of folks are not aware that certification expire soon after 5 years. Given that they haven’t been applied inside that time, these are no more probably going to be legitimate. In truth, it’s typical for a card or certificate to expire for more than ten years; therefore, if you want to continue using it, you must obtain a new one. You are protected from this circumstance by the law. That’s the good news.

As soon as your certification is a result of expire, SSL official document providers send out notifications with their submission details. When your certificate comes up for renewal, your Point-of-Contact might not be available,. That is the issue. In reality, if the official document comes to an end, you may have a campaign or get fired. Fortunately, by making use of these methods, you could possibly avoid this situation. You could increase the lifestyle of your own SSL certificate using these straightforward tips.