Non Profit Sales Tax Exemption Form Ohio – In order to be exempt from sales tax, an employee must be able to make sales. This is certainly often completed by making advertising purchases or assisting one more staff near bargains. The worker have to, however, engage in independent product sales efforts. Moreover, the outer sales exemption only pertains to staff members who execute organization away from the company’s establishments, like at trade exhibits. Otherwise, a third party income exemption record must be introduced through the employee. Each and every time an employee engages in outside income action, this form is essential. Non Profit Sales Tax Exemption Form Ohio.

Sales taxes is just not suitable to low-profit agencies.

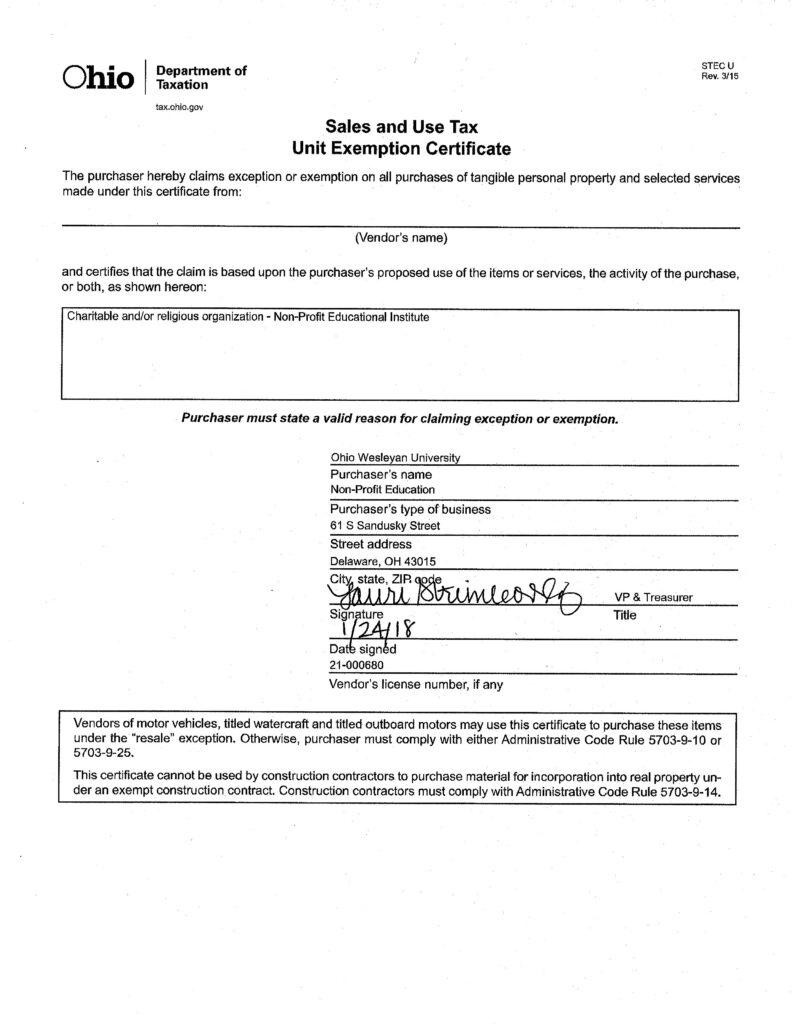

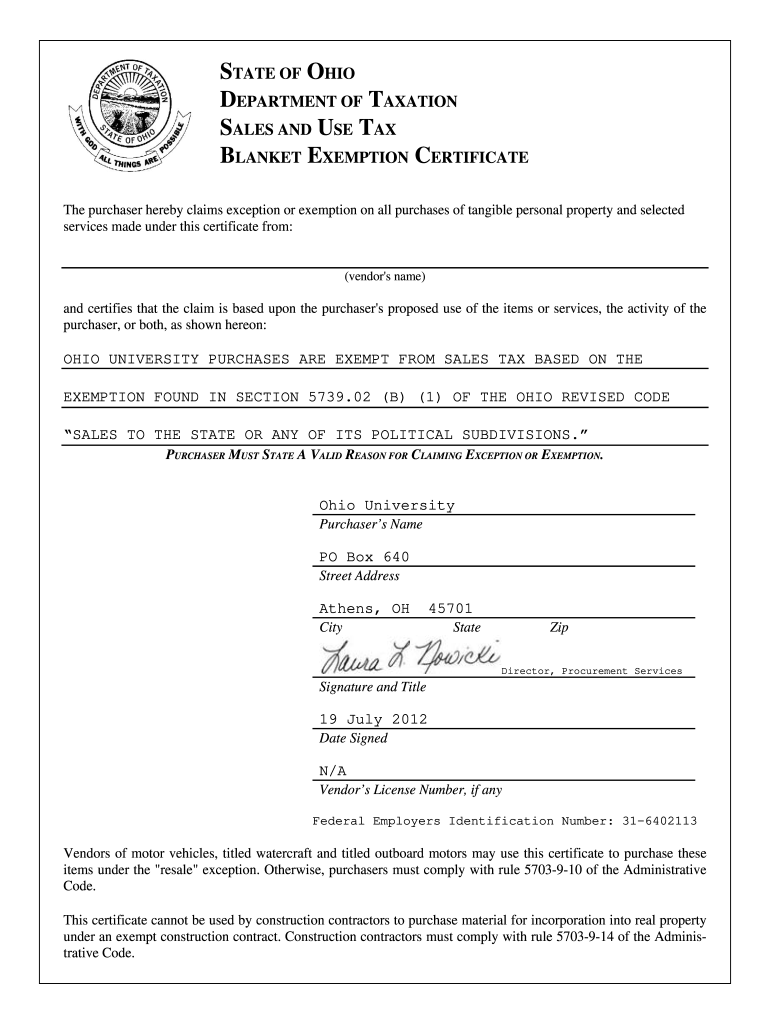

A 501(c)(3) non-profit business is normally exempt from having to pay product sales taxation, yet it is not exempt from gathering or remitting it. However, the nonprofit organization is permitted to sell taxable goods without collecting sales tax as long as it complies with specific standards. Tangible personalized house is what not for profit organizations can offer that is taxable. Nonprofit organizations must match the condition-certain requirements for exemption.

The organization needs to fulfill a number of criteria, such as purpose, payment, and purchase quantity, in order to qualify as a nonprofit. Income taxation exemptions for nonprofits must be required inside their house state as well as any nearby suggests. Attaining product sales-tax exemptions in numerous says, for example together with the Efficient Product sales and make use of Taxes Contract Certification of Exemption, can also be advantageous for nonprofit agencies. Nonprofits should, nevertheless, generally know about the limitations put on revenue-tax exemptions.

Revenue income tax will not be used on on-line merchants.

The majority of internet sellers are free from collecting sales tax, but the number of exemptions is rapidly rising, according to a recent survey. These exclusions provide little, locally owned and operated enterprises a significant edge for them to contend with major countrywide merchants. The competitiveness and profitability of small enterprises will suffer if these exclusions are eliminated. When compared with large organizations, tiny enterprises are often far more entrepreneurial and versatile when it comes to new technological innovation.

In fact, the Wayfair judgment places a unique focus on on-line marketplaces and mandates that they can accumulate product sales taxation from their third-party sellers. Numerous on the internet vendors, which include Amazon . com, eliminated this will need for several years prior to starting to cost sales tax to the goods and services they feature. Even with experiencing physical places in certain states, Amazon only gathers revenue income tax about the merchandise they offer right to shoppers. These vendors have to to cautiously analyze their business online method and make sure that this appropriate income tax will be paid out.

You need to send Type Saint-12.

When requesting a revenue taxation exemption, a valid certification of exemption is important. If a purchase is made with the principal use in mind, a sales tax exemption may be requested. A real private piece or service is reported to be in its main use when it is applied for about 50% of times. A income tax exemption certificate needs to be provided to the seller with the buyer of your exempt excellent or support. The owner is responsible for offering evidence.

By submitting Form ST-12, a firm can request a tax exemption certificate. The seller is required to give the vendors the form in order to withdraw it if the company is no longer eligible for the sales tax exemption. The usage of exemption use accreditation is governed by Massachusetts Legislation (830 CMR 64H.8.1). Criminal consequences may apply if an exemption certificate is knowingly misused. A company could face equally civil and criminal fees and penalties for deliberately busting this principle.

The certificate’s several-year expiry day

Nearly all folks are ignorant that accreditations expire right after 5yrs. Because they haven’t been used in that point, these are no more likely to be reputable. If you want to continue using it, you must obtain a new one, in truth, it’s typical for a card or certificate to expire for more than ten years; therefore. You are protected from this circumstance by the law. That’s the good news.

As soon as your certificate is due to expire, SSL qualification companies deliver notifications with their submission lists. When your certificate comes up for renewal, your Point-of-Contact might not be available,. That is the issue. Actually, if the official document comes to an end, you may get yourself a marketing or get fired. Luckily, by making use of these tactics, you may avoid this scenario. You may increase the lifestyle of your SSL certificate using these effortless tips.