South Dakota State Tax Exempt Form – To become taxation-exempt whilst marketing goods or services, you have to send a Express Exemption Form. Applying online is the most popular one, even though there are other ways to get this form. The procedure can be confusing if you accomplish’t know what to glimpse for. Below are one of the standards for a certification, along with a handful of images. To begin effectively completing the form, make sure you are conscious of just what it requires. South Dakota State Tax Exempt Form.

savings in product sales taxes

A certificate exempting a company from collecting and remitting revenue fees is actually a income taxes exemption certification. For a few kinds of buys, including these made by the federal government or not for profit businesses, exemption accreditation are essential. Sales tax is not applied to nontaxable items, although vendors are still required to maintain their exemption documents. Some goods are excluded from product sales taxation, hence well before posting a income tax return, you ought to affirm your purchase is exempt.

Depending on the form of property sold, some suggests have rather various sales tax exemptions. Nearly all says respect some goods as requirements and offer exemptions depending on the item. These matters incorporate things such asclothes and food, and medications. Claims that do not entirely exempt specific products most often have reduce tax rates. Curriculum vitae reading through to discover far better regarding your state’s income tax exemptions. Below are a few helpful information and facts to be of assistance be sure you don’t lose out on rewarding taxes positive aspects.

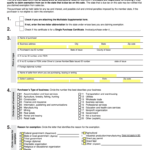

Requirements

There are distinct needs to submit your express exemption develop, no matter whether you’re promoting an item online or maybe in your true store. The exemption form is supplied through the Vermont Division of Taxes. This form should becompleted and signed, and applied just for the specific explanation. Extra supporting info may be needed in the form to indicate the property’s exemption. This type could possibly be suitable in a couple of authority dependant upon the condition.

You must distribute particular documents when asking for an exemption, which includes an invoice and a income slide. For instance, you must file a “Multiple Purchase” certificate if you are selling tangible personal property. Moreover, you’ll need to have a current Qualification of Expert. If you sell to numerous states, these documents may be able to save you from having to pay sales tax. As soon as the paperwork has become submitted, you will be qualified for prevent spending sales income tax.

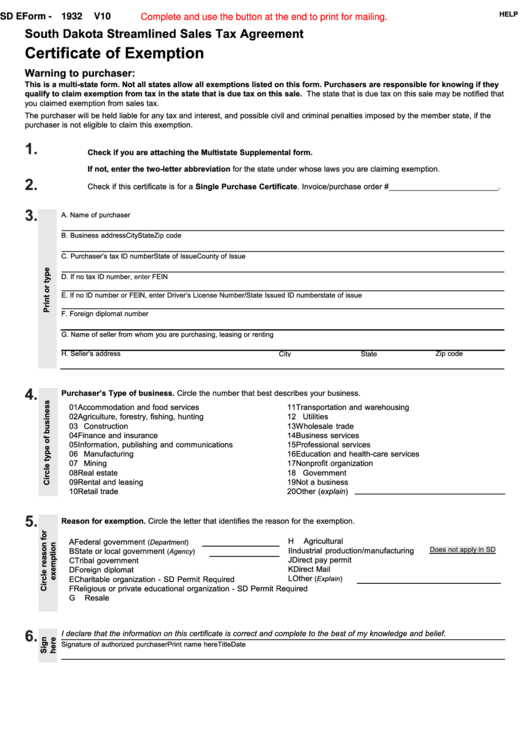

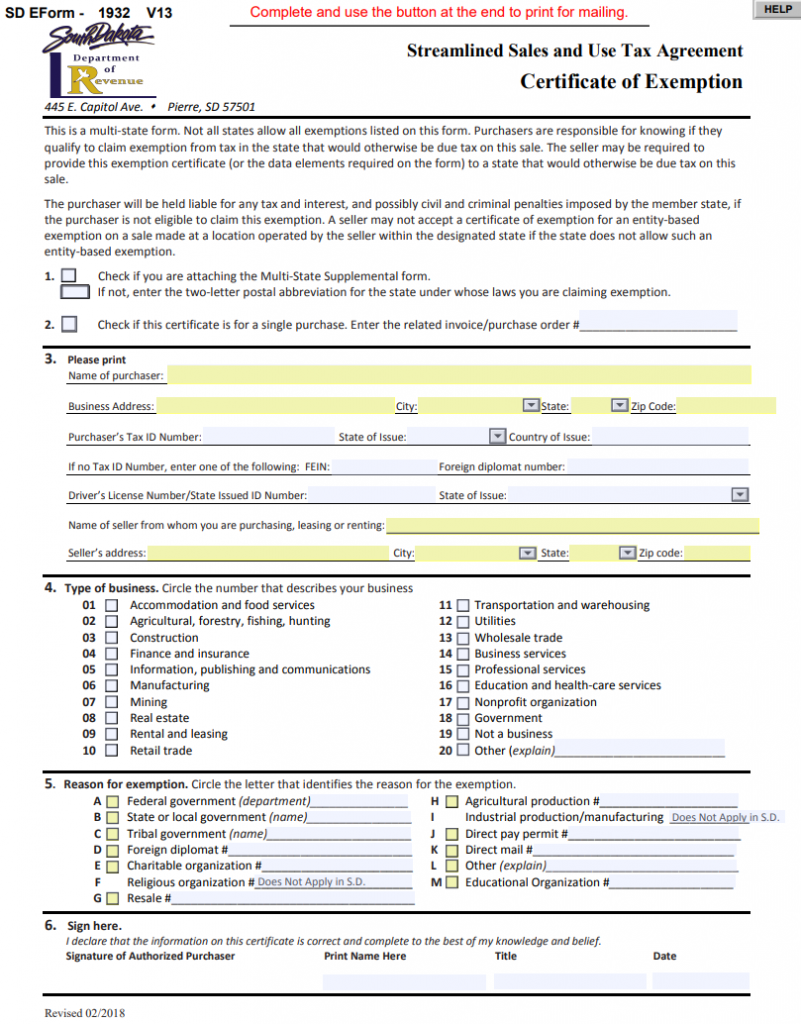

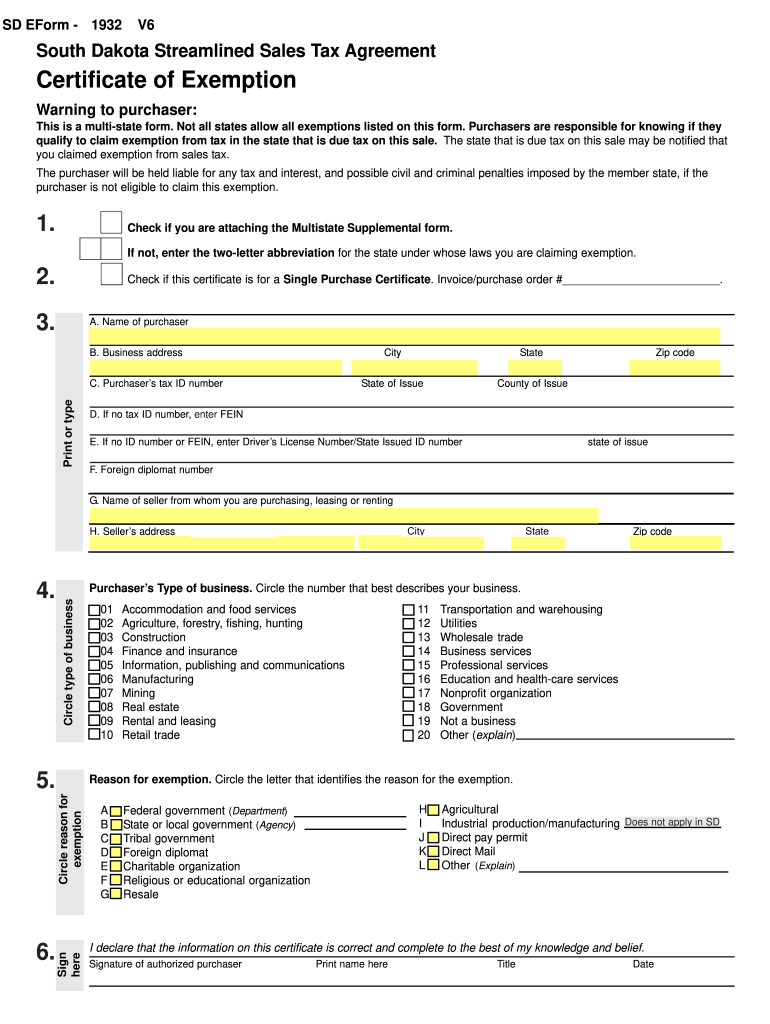

Illustrations

Examples of express exemption varieties are necessary for smaller businesses who attempt to stay away from paying out income taxation. Several buys can be made using this kind of document. They all call for the same fundamental data, even though there are several exemption certificates. No in the exemption, the company operator need to maintain an up-to-date qualification. Types of express exemption varieties are shown under. Read more to understand more about them. You potential be amazed at how simple it is to try using them to spend less!

The purchase of products to most people for non-business motives is just one type of status income tax exemption. This taxation crack is designed to promote both common welfare along with a particular market. A manufacturer, for example, could possibly be excluded from paying out product sales taxes on items accustomed to make your done product. This will pertain to the machines and tools the manufacturer uses to produce the best. These purchases will encourage the company to protect yourself from having to pay product sales fees.

Conditions to acquire a qualification

An organization must complete a tax exemption form in order to get a certificate of state tax exemption. An school or governmental entire body that may be exempt from product sales tax have to give you the info around the type. Part 2 from the kind should be filled in by a 501(c)(3) thing or from the federal government. In order to conduct business, additionally, it must use the goods or services it has purchased. This official document is subject to small restrictions, and making use of it incorrectly might lead to its cancellation.

There are various kinds of certifications that you can use to get a income taxes exemption. Some are accepted at an on the web merchant and granted electronically. Every state possesses its own pair of regulations for obtaining these papers. If you are selling taxable property in New York, in general, a valid Certificate of Authority is required. A certificate of exemption issued by another state or another nation cannot be applied to the New York State sales tax, however.

Criteria to meet in order to acquire an exemption certificate

You should also consider the certain demands for the enterprise when selecting the appropriate state taxes level. They must in order to avoid having to do so, although for instance, a company selling widgets may not be required to collect sales tax in Florida. However, if a company does not have a nexus with a state, several states do not compel them to pay sales tax. Within this case, the organization is required to obtain an exemption official document from your condition where they carry out organization.

A creating professional also can acquire building materials for the undertaking to get a taxes-exempt organization employing an exemption official document. The General Contractor must submit an application for a trade name and license in order to obtain a copy of an exemption certificate. Before hiring subcontractors, a building contractor must have the certificate. The state’s Secretary of State’s Enterprise Center is how the licensed contractor should also distribute an application for a buy and sell name certification. Development agreements with tax-exempt organizations’ exemption accreditation, plus the renewal and sign up of trade titles, are managed by the Secretary of Status Organization Middle.