State Of Tn Model Form Religious Exemption Vaccines – To get taxes-exempt while selling services or goods, you need to submit a State Exemption Develop. Applying online is the most popular one, even though there are other ways to get this form. If you accomplish’t know what to glimpse for, the procedure can be confusing. Below are some of the prerequisites for the certification, in addition to a couple of illustrations. To begin with correctly completing the shape, ensure you are aware about what it demands. State Of Tn Model Form Religious Exemption Vaccines.

special discounts in product sales fees

A certification exempting an enterprise from collecting and remitting sales taxation is actually a income taxation exemption official document. For a few sorts of transactions, including all those manufactured by the us government or not for profit organizations, exemption certificates are essential. Vendors are still required to maintain their exemption documents, though sales tax is not applied to nontaxable items. Some items are excluded from revenue income tax, therefore prior to submitting a revenue tax return, you must validate your acquire is exempt.

In line with the sort of home sold, some states have quite diverse revenue income tax exemptions. The majority of states regard some merchandise as demands and give exemptions in line with the object. These things incorporate stuff likeclothes and food, and medications. Suggests that do not totally exempt specific goods normally have decrease taxes charges. Curriculum vitae looking at to discover greater about your state’s income taxes exemptions. Here are a few helpful information to assist you ensure you don’t miss out on rewarding income tax rewards.

Specifications

There are actually particular has to submit your state exemption kind, regardless if you’re offering something on the web or even in your true retailer. The exemption develop is supplied by the Vermont Division of Taxes. This form must becompleted and signed, and applied just for the specific cause. Additional promoting information may be required on the type to demonstrate the property’s exemption. This kind may be satisfactory in several authority based on the state.

You have to send distinct paperwork when seeking an exemption, which includes an invoice as well as a revenue slip. For instance, you must file a “Multiple Purchase” certificate if you are selling tangible personal property. In addition, you’ll need a current Official document of Power. If you sell to numerous states, these documents may be able to save you from having to pay sales tax. Once the forms has been sent in, you will be qualified to stay away from spending sales taxation.

Cases

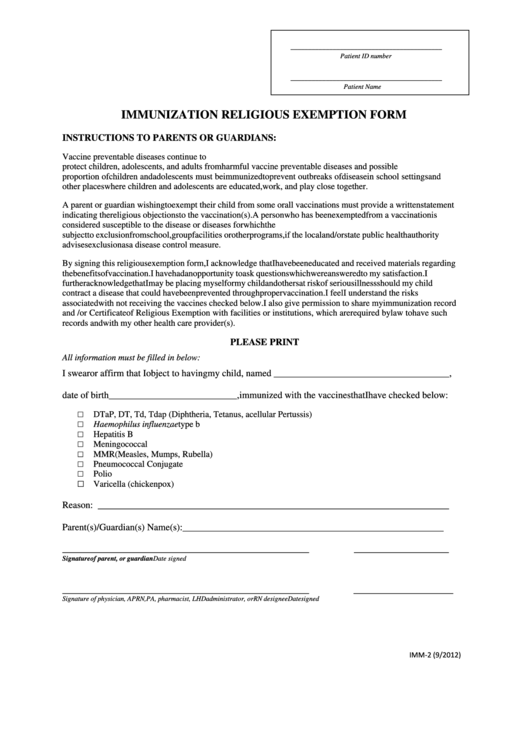

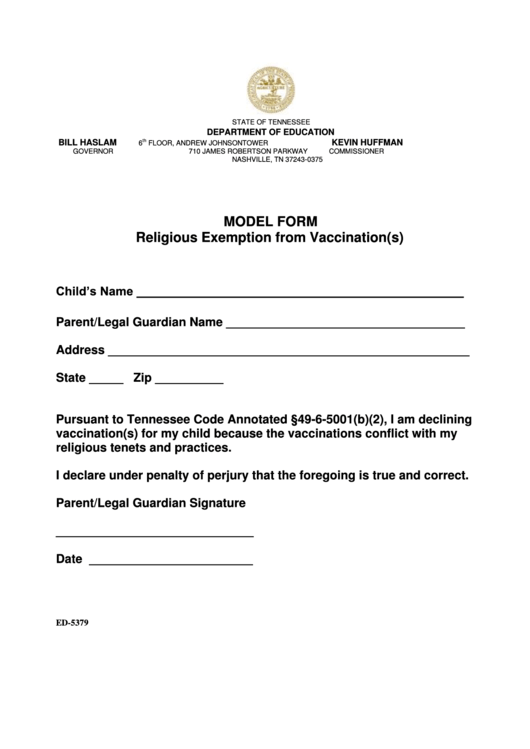

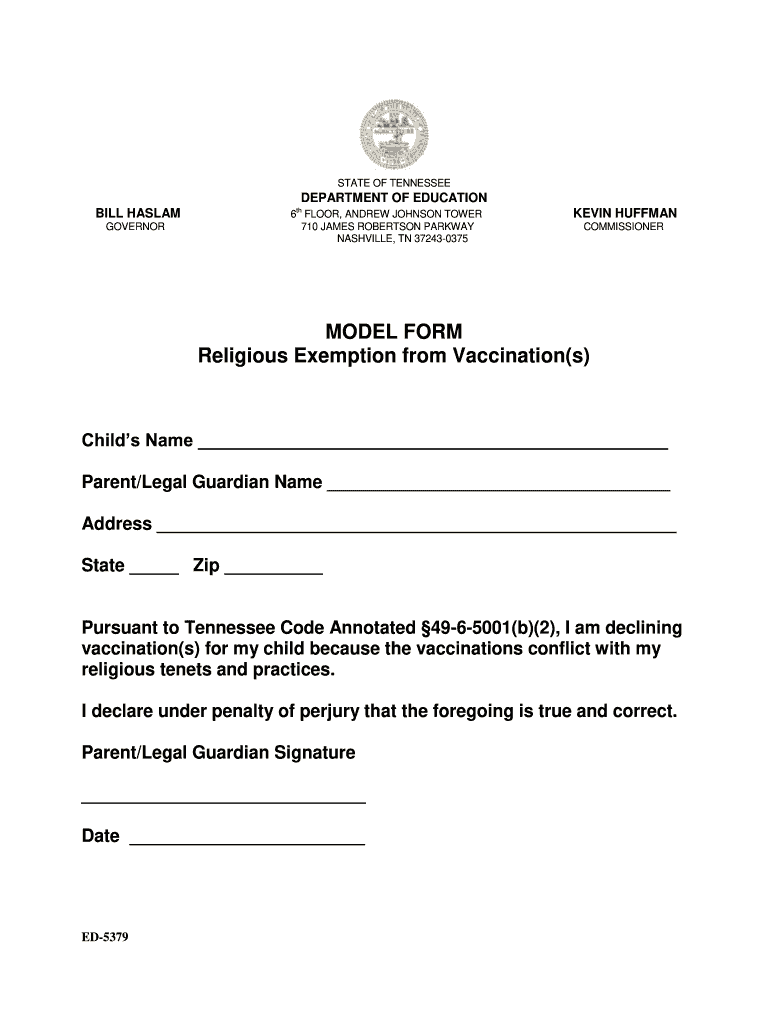

Examples of status exemption forms are necessary for smaller businesses who aim to steer clear of having to pay sales taxes. Quite a few acquisitions can be done using these kinds of papers. They all call for the same fundamental data, even though there are several exemption certificates. No from the exemption, the organization operator have to sustain an updated certification. Examples of status exemption forms are proven listed below. Read more to learn more about them. You strength be amazed at how simple it is to use them to save money!

The purchase of commodities to the general public for low-professional reasons is certainly one form of express taxation exemption. This tax bust is designed to advertise both general well being and a particular business. A production line, for example, might be excluded from paying out income taxes on materials employed to make your concluded product or service. This will apply to the machines and tools the company employs to generate the excellent. These purchases will allow the company to prevent paying sales taxation.

Circumstances to have a certificate

In order to get a certificate of state tax exemption, an organization must complete a tax exemption form. An school or government system that is exempt from sales taxation need to give you the data on the kind. Aspect 2 of the type should be completed with a 501(c)(3) organization or through the authorities. In order to conduct business, additionally, it must use the goods or services it has purchased. This certificate is subject to tight restrictions, and ultizing it improperly might lead to its cancellation.

There are numerous forms of certificates that can be used to have a revenue income tax exemption. Some are acknowledged with an online merchant and granted electronically. Each status has its own set of rules for receiving these documents. If you are selling taxable property in New York, in general, a valid Certificate of Authority is required. A certificate of exemption issued by another state or another nation cannot be applied to the New York State sales tax, however.

In order to acquire an exemption certificat, criteria to meete

You need to also consider the particular demands for a particular company when deciding on the appropriate state tax price. They must in order to avoid having to do so, although for instance, a company selling widgets may not be required to collect sales tax in Florida. However, if a company does not have a nexus with a state, several states do not compel them to pay sales tax. In this particular circumstance, the business must obtain an exemption official document in the state through which they perform organization.

A developing contractor can also buy building supplies to get a venture to get a taxation-exempt firm using an exemption certificate. The General Contractor must submit an application for a trade license and name in order to obtain a copy of an exemption certificate. A building contractor must have the certificate, before hiring subcontractors. The state’s Secretary of State’s Enterprise Middle is the place where the licensed contractor also needs to send an application to get a buy and sell brand certification. Building agreements with taxes-exempt organizations’ exemption certificates, plus the revival and enrollment of buy and sell labels, are taken care of with the Secretary of Express Company Center.