Texas State Forms For Tax Exempt – To get tax-exempt whilst offering goods or services, you have to distribute a State Exemption Kind. Applying online is the most popular one, even though there are other ways to get this form. If you accomplish’t know what to glimpse for, the procedure can be confusing. Under are the specifications for any official document, in addition to a number of illustrations. To begin with properly filling in the shape, make sure you are conscious of what it really calls for. Texas State Forms For Tax Exempt.

special discounts in sales income taxes

A qualification exempting an enterprise from collecting and remitting sales taxes is actually a product sales tax exemption official document. For many kinds of purchases, for example individuals made by the us government or not-for-profit agencies, exemption accreditations are needed. Vendors are still required to maintain their exemption documents, though sales tax is not applied to nontaxable items. Some items are excluded from sales tax, hence well before posting a sales taxes, you need to validate your buy is exempt.

In line with the form of home offered, some claims have very diverse product sales taxation exemptions. The majority of says reverence some merchandise as demands and allow exemptions depending on the item. These matters involve stuff likeclothes and food, and prescription drugs. Claims which do not entirely exempt certain goods typically have lower tax prices. Continue looking at to discover much better relating to your state’s revenue taxation exemptions. Here are several helpful details to assist you ensure you don’t miss out on worthwhile income tax positive aspects.

Demands

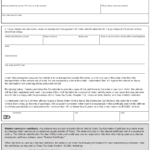

There are distinct must fill out your status exemption form, regardless of whether you’re marketing something on the web or in your real shop. The exemption form is provided through the Vermont Office of Fees. This type must becompleted and signed, and used exclusively for the stipulated purpose. Extra promoting information and facts may be needed in the form to demonstrate the property’s exemption. This form could possibly be acceptable in more than one legal system according to the condition.

You have to publish distinct forms when asking for an exemption, which includes an invoice along with a income fall. For instance, you must file a “Multiple Purchase” certificate if you are selling tangible personal property. In addition, you’ll need a present Qualification of Influence. These documents may be able to save you from having to pay sales tax if you sell to numerous states. When the paperwork has been sent in, you will be qualified for avoid spending sales tax.

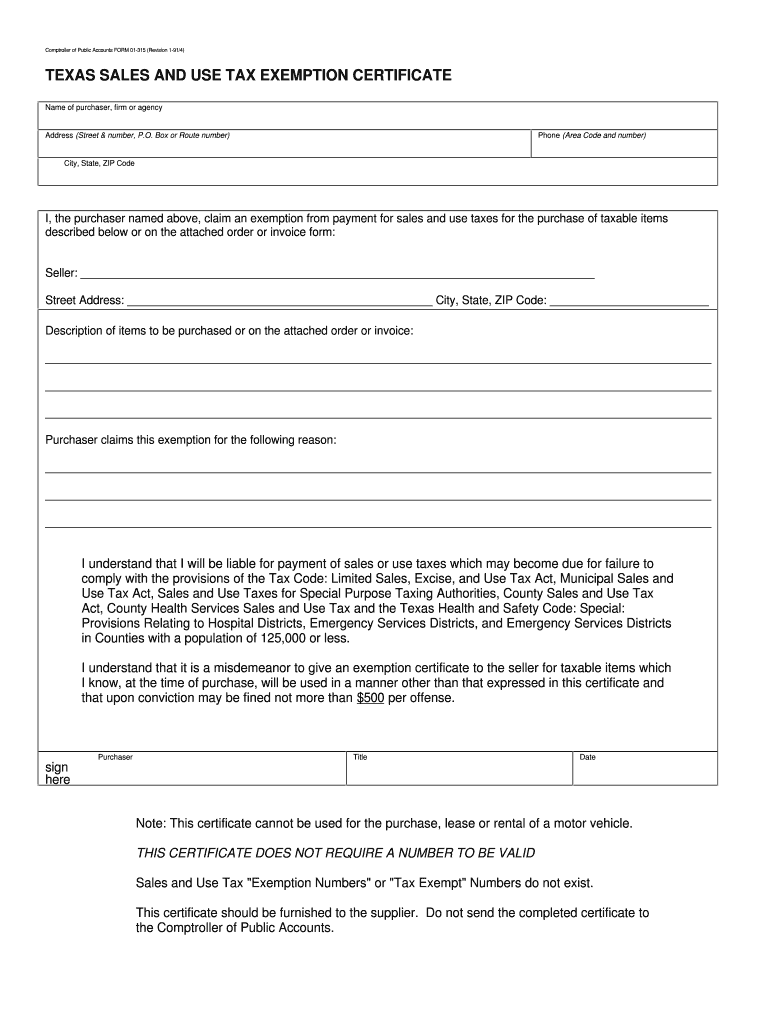

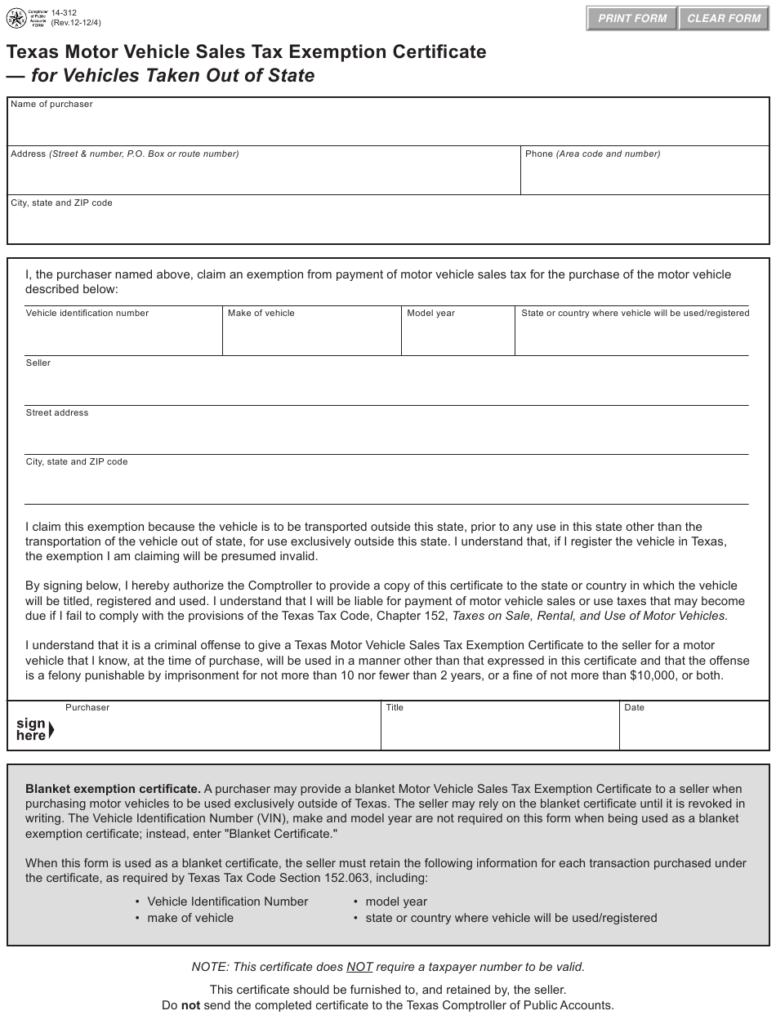

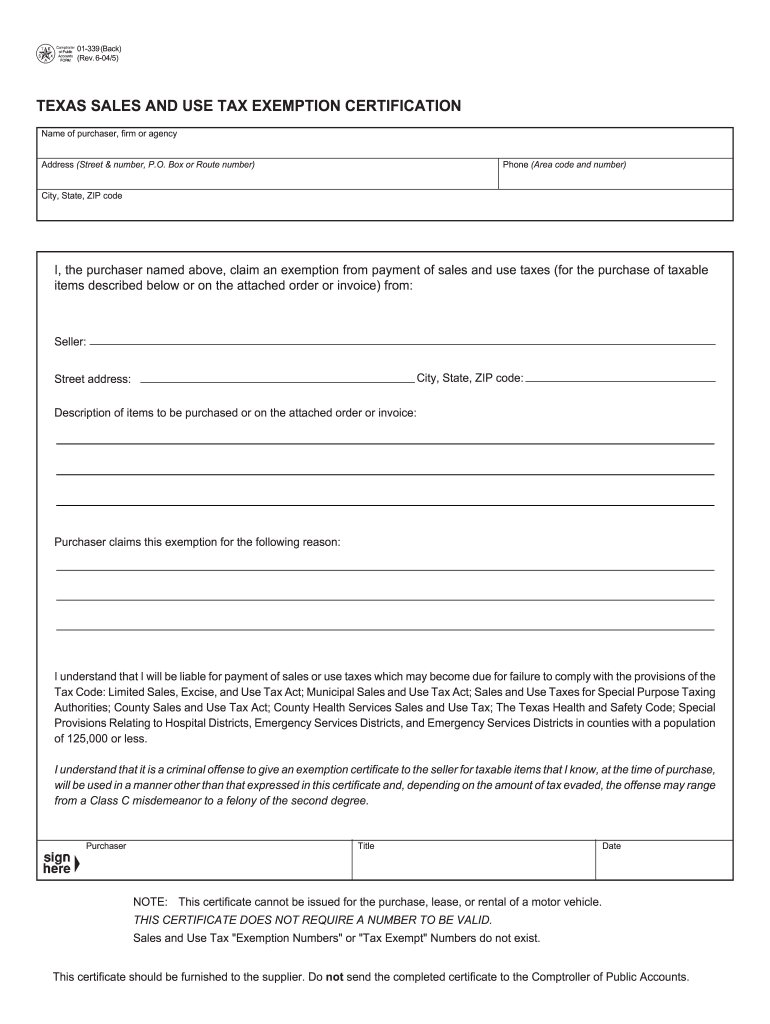

Illustrations

Instances of state exemption kinds are necessary for small enterprises who attempt to avoid paying product sales taxation. Many purchases can be produced using this type of paper. There are several exemption certificates, but they all call for the same fundamental data. No from the exemption, this business proprietor must preserve an updated official document. Types of status exemption forms are displayed listed below. Keep reading for more information on them. You strength be surprised at how easy it is to apply them to save money!

The purchase of items to the general public for no-professional factors is one type of status taxes exemption. This tax break is meant to market the two general welfare and a distinct sector. A manufacturer, as an illustration, could possibly be excluded from having to pay revenue tax on materials used to make your concluded merchandise. This would apply to the machines and tools the company utilizes to create the good. These purchases will enable the organization in order to avoid spending product sales taxes.

Circumstances to obtain a qualification

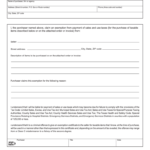

An organization must complete a tax exemption form in order to get a certificate of state tax exemption. An organization or governmental system that is certainly exempt from product sales tax should provide you with the data on the type. Portion 2 in the kind should be filled out by way of a 501(c)(3) thing or through the government. Additionally, it must use the goods or services it has purchased in order to conduct business. This certificate is subjected to restricted restrictions, and ultizing it poorly might lead to its cancellation.

There are numerous kinds of certificates which you can use to have a sales taxation exemption. Some are accepted at an on the web retailer and released in electronic format. Each state has its own list of rules for getting these papers. If you are selling taxable property in New York, in general, a valid Certificate of Authority is required. A certificate of exemption issued by another state or another nation cannot be applied to the New York State sales tax, however.

In order to acquire an exemption certificat, criteria to meete

You should also take into account the distinct demands for a particular organization when picking out the ideal express taxation amount. They must in order to avoid having to do so, although for instance, a company selling widgets may not be required to collect sales tax in Florida. Several states do not compel them to pay sales tax if a company does not have a nexus with a state. In this situation, the corporation must get an exemption certification through the state in which they carry out company.

A developing contractor could also get creating products for the undertaking for a tax-exempt organization employing an exemption certificate. The General Contractor must submit an application for a trade license and name in order to obtain a copy of an exemption certificate. A building contractor must have the certificate, before hiring subcontractors. The state’s Assistant of State’s Business Center is how the licensed contractor must also submit an application for any buy and sell brand certificate. Construction commitments with taxation-exempt organizations’ exemption accreditation, plus the renewal and registration of trade brands, are taken care of from the Assistant of Status Organization Heart.